Many traditional telecom companies consider voice OTT to be either a niche technology championed by cash-strapped challengers unlikely to cause major upset, or an opportunity of modest proportion hampered by poor monetization, inferior QoS and challenged business models. Based on pending operator response, regulatory action and monetization efforts among the OTT players themselves, OTT could either remain only an innovative breeze or develop into a disruptive force. In this Viewpoint, Arthur D. Little identifies the key trends in the OTT sector with a focus on mVoIP, its primary challenges and key success factors in order to assess three OTT development scenarios. Depending on the scenario, Arthur D. Little expects mobile voice OTT market size to range between $14-100 billion in 2016, accounting for between 2 – 20 percent of total voice revenues. Whichever the scenario, it is clear that operators must develop strategies to respond to a world with mobile voice OTT presence.

Many traditional telecom companies consider voice OTT to be either a niche technology championed by cash-strapped challengers unlikely to cause major upset, or an opportunity of modest proportion hampered by poor monetization, inferior QoS and challenged business models. Based on pending operator response, regulatory action and monetization efforts among the OTT players themselves, OTT could either remain only an innovative breeze or develop into a disruptive force. In this Viewpoint, Arthur D. Little identifies the key trends in the OTT sector with a focus on mVoIP, its primary challenges and key success factors in order to assess three OTT development scenarios. Depending on the scenario, Arthur D. Little expects mobile voice OTT market size to range between $14-100 billion in 2016, accounting for between 2 – 20 percent of total voice revenues. Whichever the scenario, it is clear that operators must develop strategies to respond to a world with mobile voice OTT presence. Several ambitious OTT players have already had an impact on mVoIP growth and on the total voice market. Skype, for instance, already represents over 25 percent of cross-border international call minutes. The company, which has been disruptive since its launch, is now focusing on business users, in addition to mobile users and HD voice. Microsoft’s acquisition of Skype can lead to voice becoming just another application on your smart device. Microsoft is expected to integrate Skype more deeply into Lync, Outlook, Xbox Live, Hotmail and Messenger. The company can also enable the same service on various devices powered by Windows, including Nokia smartphones, computers and tablets. As an investor in Facebook, Microsoft is expected to fully utilize the social network with Skype-powered video calling on Facebook’s mobile application, bringing mVoIP to the mainstream. The effective combination of these efforts may enable Skype to have a stronger impact on the market.

Several ambitious OTT players have already had an impact on mVoIP growth and on the total voice market. Skype, for instance, already represents over 25 percent of cross-border international call minutes. The company, which has been disruptive since its launch, is now focusing on business users, in addition to mobile users and HD voice. Microsoft’s acquisition of Skype can lead to voice becoming just another application on your smart device. Microsoft is expected to integrate Skype more deeply into Lync, Outlook, Xbox Live, Hotmail and Messenger. The company can also enable the same service on various devices powered by Windows, including Nokia smartphones, computers and tablets. As an investor in Facebook, Microsoft is expected to fully utilize the social network with Skype-powered video calling on Facebook’s mobile application, bringing mVoIP to the mainstream. The effective combination of these efforts may enable Skype to have a stronger impact on the market.

Many traditional telecom companies consider voice OTT to be either a niche technology championed by cash-strapped challengers unlikely to cause major upset, or an opportunity of modest proportion hampered by poor monetization, inferior QoS and challenged business models. Based on pending operator response, regulatory action and monetization efforts among the OTT players themselves, OTT could either remain only an innovative breeze or develop into a disruptive force. In this Viewpoint, Arthur D. Little identifies the key trends in the OTT sector with a focus on mVoIP, its primary challenges and key success factors in order to assess three OTT development scenarios. Depending on the scenario, Arthur D. Little expects mobile voice OTT market size to range between $14-100 billion in 2016, accounting for between 2 – 20 percent of total voice revenues. Whichever the scenario, it is clear that operators must develop strategies to respond to a world with mobile voice OTT presence. OTT players lead the second phase of VoIP innovationThe high cost of voice calls has long provided incentives for new players to find ways to market by offering lower cost services. With its launch in the mid-1990s, VoIP was hyped as the greatest threat to traditional telecom revenue. Yet initial efforts by players, such as cable and VoBB (Voice over Broadband) providers, had limited success in challenging operators’ market positions. Hence, until recently both telecom companies and experts regarded the threat from OTT as negligent. Such perception is now changing as the emerging second phase of VoIP innovation, led by highly sophisticated and innovative companies, is demonstrating a potential to cause a major impact on the traditional voice market. In this new phase of VoIP innovation, voice players are providing value beyond free and lower call rates by offering many convenient and consumer sweet-spot features, which have led to increased consumer demand for OTT. Several providers, such as Fring, Tru and Mig33, focus largely or exclusively on mobile VoIP (mVoIP). Others, such as Skype, Google Voice, Jajah, Rebtel and Raketu offer mVoIP as part of their broader web-activated business. The mobile connectivity component is getting further accentuated through mVoice apps on iPhone and Android smartphones (Figure 1). Several ambitious OTT players have already had an impact on mVoIP growth and on the total voice market. Skype, for instance, already represents over 25 percent of cross-border international call minutes. The company, which has been disruptive since its launch, is now focusing on business users, in addition to mobile users and HD voice. Microsoft’s acquisition of Skype can lead to voice becoming just another application on your smart device. Microsoft is expected to integrate Skype more deeply into Lync, Outlook, Xbox Live, Hotmail and Messenger. The company can also enable the same service on various devices powered by Windows, including Nokia smartphones, computers and tablets. As an investor in Facebook, Microsoft is expected to fully utilize the social network with Skype-powered video calling on Facebook’s mobile application, bringing mVoIP to the mainstream. The effective combination of these efforts may enable Skype to have a stronger impact on the market.Google Voice, together with Skype, is likely the most powerful disruptive force, integrating several applications and services. Google Voice’s services have the potential to impact both OTT players like Skype, as well as traditional telecom business. As seen in the partnership with Sprint in US, Google Voice can enable both challengers and incumbents to preserve their market positions, as well as advance its own business. Google Voice is also backed by a financially strong company, which has repeatedly demonstrated its determination to disrupt various markets and sectors.Other players with strong brand capability and financial strength to cause powerful disruption, such as Apple, have already turned their attention to this market. In particular, Apple has pushed the so-called soft SIM, which could further drive the development of alternative mVoIP services and a continued commoditization of mobile voice; with the development of soft SIMs, traditional players may, in the long run, lose the direct customer relationship altogether to the advantage of OTT players or third parties.Although mVoIP represents a threat to the traditional telecom value chain, it could also provide opportunities for market players, through partnerships between mobile operators, handset vendors and mobile voice OTT providers. Going forward, telecoms are expected to move away from blocking or penalizing the usage of VoIP services, in order to avoid the risk of alienating a significant portion of their customer base and increasing churn. Operators can use partnerships as opportunities to establish themselves as innovators and gain market share through cost-efficient customer acquisition. Handset vendors may use partnerships as an opportunity to increase revenues by expanding their footprint in the value chain and increase end-user exposure. Voice OTT providers will consider partnerships as a chance to monetize their existing user base and accelerate the number of mVoIP users by getting access to operators’ customer base.Key trends enforcing growth of mobile voice OTTOTT mVoIP could either be a disruptive threat or an innovative opportunity for market players along the value chain. Based on extensive analysis of the mobile voice OTT market, Arthur D. Little has identified key trends that are influencing the development of the mobile voice OTT industry. Mobility: The rapid increase in penetration of mobile broadband and portable smart devices together with the increased popularity of flat fee packages, are expected to have a positive impact on the use of mVoIP services. However flat fees will bring voice prices down, and are expected to discourage some customer segments to arbitrage on voice. OTT players are well positioned to leverage the mobility trend with their appealing mVoIP applications. Partnerships: Partnerships between mobile operators, handset vendors and mobile voice OTT providers are expected to increase. For telecom companies, partnerships with mVoIP OTT players could provide opportunities in terms of enhanced customer experience, expanded services, enabling the operators to position themselves as innovators, limiting risks and investments in content production, and extending the market reach. Integration: Mobile voice OTT is expected to become a seamless part of websites or applications, not previously focused on voice communication. Social media, online gaming and dating sites are integrating OTT voice as a part of a larger user experience. For example, Vivox works in conjunction with its partners, such as T-Mobile in the US, to deliver HD voice solutions that are built seamlessly into applications. The Vivox Bobsled application for T-Mobile subscribers on Facebook aims to provide users with free, one-touch calling to their Facebook friends. Smart functionality: mVoIP providers will continue to develop innovative features, increase convenience and enhance customer value beyond price savings. Popular features, such as Google Voice’s transcription of voicemail services into text, verbal activation of services, consolidation into one GUI (graphical user interface) and automated language translation by Jajah have a strong appeal, and could motivate users to subscribe to premium services. Net neutrality: Regulators worldwide are expected to follow developed countries such as the US, the EU, and Japan, and seek to secure net neutrality with greater transparency, no blocking or unreasonable discrimination. Such development will provide favorable conditions for OTT industry growth globally. Investor enthusiasm: Until recently, Venture Capital and Angels have constituted the principal source of funding for mobile voice OTT players. Large private equity and ICT companies are investing more as players enter the high growth phase. The acquisition of Skype by Microsoft is one such example. Factors enab

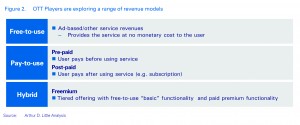

ling mobile voice OTT to overcome challengesMobile voice OTT services have already diversified from pure voice to a complete multimedia experience. However, players still face substantial challenges: Quality of Service (QoS): Poor speech quality and dropped calls disappoint paying subscribers used to high QoS in circuit-switched telephony. To provide a universal commu-nication service quality, mVoIP providers will have trouble avoiding the long-established system of interconnection payments between national operators. Unless this market is regulated, many smaller OTT players will be at a signifi cant disadvantage. Pricing: Competitive pressure between communication service providers, regulatory rulings on termination rates and technology upgrades will continue to reduce the cost of tra-ditional voice telephony, posing a signifi cant threat to mVoIP service providers that use cheap calls as an acquisition tool. Monetization: The greatest challenge mobile voice OTT providers face will be monetization of their service. Most players, including Skype, have yet to substantially monetize their large user base, as conversion rates to paying users have to date been very low. In response, OTT players have applied a variety of revenue models, from ad-based, pre- and post-paid to freemium and customized. Pre-paid has been a common model; calls to circuit-switched networks attract a charge payable to the operator of the terminating network with a small margin for the mVoIP provider. Recently, OTT players have had some success with advertising as a poten-tial source of revenue, hence moving to Freemium models (Figure 2). Secondly, pricing models with free user-to-user calls will eventually reach an infl ection point. Revenues, which increased as new customers signed up and paid to call-out, start to decline as the number of free user-to-user calls increases along with user base.Going forward, successful mVoIP providers are expected to offer multiple communications services, as well as services aligned with the key needs of targeted markets. However, this alone will not be sufficient, and Arthur D. Little has identified several success factors that players need to consider:

Rich offering: As competition gets fi ercer, players are under pressure to continuously innovate and bundle appealing features in order to attract and maintain paying users.

Large, active user base: While most players have a signifi -cant number of registered users, it is the proportion of active users that will determine the upside potential.

Partnering with operators: mVoIP providers will benefi t from partnering with operators, providing access to opera-tor’s user base and high quality network services.

Strong brand: The brand is essential to build and retain a user base and enable partnerships. Skype is the most well known mVoIP brand; however, Google has the strongest brand to leverage globally.

Suitable business model: Monetization will remain the key challenge for mVoIP providers. Adopting the right business model will be critical for sustainable success.

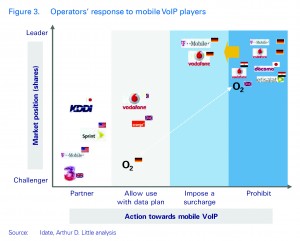

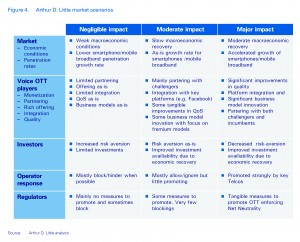

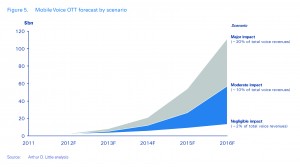

Competitive price: There are still arbitrage opportunities in mobile services, particularly for international calls and roaming, and consumers will continue to be price-focused. While free or extremely low prices will jeopardize players’ commercial sustainability, competitive pricing will be a key success factor.Telco and regulator attitude towards mobile voice OTT is changingOperator attitude towards mobile voice OTT players varies depending on particular market conditions and the position of the operator. A number of market leaders, including incumbents, have prohibited or hindered the use of mobile voice OTT. There has been a shift in this strategy, as some market leaders who initially banned usage are now exploring new revenue models. For instance, T-Mobile and Vodafone Germany have lifted the ban on VoIP and imposed a surcharge. Often a market player’s response to OTT has depended on the strength of their leadership in the local market. For example, in Germany O2 has chosen to allow OTT use with data plans, but has banned use in the United Kingdom. The stronger the market leaders’ position, the more prohibitive the attitude towards OTT has been. Challenger  telecoms, on the other hand, employ a different strategic approach towards OTT. They have been using VoIP to enter markets, and to strengthen their market positioning by using partnerships with OTT players as means of differentiation (Figure 3). Regulator attitude towards OTT varies depending on the stage of development in the country. In developed countries, such as the US, the EU and Japan, regulators enforce net neutrality, and promote openness and lack of discrimination. In contrast, some less developed countries have ruled against voice OTT. For instance, in the Middle East, many governments have blocked Skype. However, the ban on using mVoIP software in UAE was recently lifted by the regulatory authority to promote cheaper voice. In China, VoIP (PC-to-phone) is classified as a basic voice call service, thus only major operators with basic telecom service licenses are allowed to provide mVoIP services. Going forward, regulators in developed countries are expected to focus on ensuring net neutrality and third party access. Some less developed countries with public telecom services or that recognize substantial income from international termination are more likely to regulate against OTT players in near term. However, in the long run, we expect most countries to shift towards increased net neutrality.Mobile voice OTT has considerable growth potentialArthur D. Little has conducted in-depth analysis of OTT’s growth potential based on interviews with more than 50 telecom and OTT CxOs globally. Based on this research, Arthur D. Little developed three main market scenarios based on the above-stated growth factors: negligible impact, moderate impact and major impact (Figure 4).Negligible impact This scenario assumes continued weak macroeconomic conditions worldwide, resulting in a slower growth rate of mobile broadband and a lower penetration rate of mobile smart devices. Operators globally move away from flat fee data bundles and OTT players struggle to monetize their user base and continue to disappoint in terms of voice quality and user experience. As standard circuit-switched call rates continue to decline, most users do not care to arbitrage on voice. Investors will be cautious on investment in the industry. Operators can and will take measures to block or hinder OTT progress indirectly mandated by regulator inattention, even though limited partnerships and co-branding initiatives may prevail.In this scenario, Arthur D. Little forecasts mobile VoIP to still experience high growth albeit from a low base, growing from $1 billion in 2011 to $14 billion in 2016 (Figure 5). Still, it is forecasted to only represent a negligible 2 percent of total mobile voice revenues globally in 2016. Moderate impact Assuming that mobile broadband, smart devices and flat fee penetration in both developed and emerging markets will continue to grow at the same pace or slightly faster than today, mVoIP will have moderate impact. OTT would offer acceptable voice quality and persist in integrating their services seamlessly as a part of larger user experience, partnering with both major challenger operators and key players in other businesses such as social media, gaming and dating (e.g. MSN, Facebook, Match.com). Major players such as Microsoft, Google and Apple along with a range of smaller players enforce their interest in this market and find sustainable ways to monetize their user base. Investors’ appetite for the industry improves along with the overall economy. Regulators pay some attention to the non-discrimination of the industry in their efforts to promote net-neutrality. Selected customer segments in emerging markets leapfrog quickly into mobile voice OTT when mobile broadband is available while some developed telecom markets that lag in new trend adoptions start adopting OTT solutions with some delay. In this scenario, Arthur D. Little forecasts mVoIP to grow to nearly $60 billion in 2016 amounting to 10 percent of total mobile voice revenues. Cannibalization from traditional voice traffic is expected to remain limited. Major impact This scenario assumes the accelerated growth rate of mobile broadband and smart devices penetration, as well as data flat fees. Various sustainable partnerships have been developed with operators globally, including key incumbents. Significant innovations and technical improvements allow for HD voice quality with enhanced customer experience and successful monetization of voice OTT user base, such as through the successful launch and adoption of B2B OTT solutions. OTT companies continue to innovate, regularly offering customer sweet-spot functionality. Major success cases emerge, including Skype-Microsoft, to prove the concept for investors. Players gain control of a major or all parts of OTT value chain and attract substantial capital from early and growth stage investors. According to Arthur D. Little, this scenario could result in market growth from $1 billion in 2011 to more than $100 billion in 2016, with OTT claiming a high share of net new minutes of traffic added. Amounting to 20 percent of total mobile voice revenues, this scenario illustrates a disruptive potential from OTT. Such scenario would require both high volume growth and radically improved monetization performance by OTT players. Even in today’s bleak economic environment, smartphone and mobile broadband penetration is expected to continue to increase globally. Despite declining circuit-switched voice rates due to decreasing termination rates and increased bundling, there will still be arbitrage opportunities in voice. QoS remains an issue, though the quality gap vis-à-vis circuit-switched is expected to diminish by 2016. Call quality of Skype and Google Voice is improving and today in some markets is nearing that of circuit-switched. OTT players are increasingly partnering with telecom companies and social media to find ways to market and integrate voice as part of larger user experience. Many players have already moved to freemium models to monetize their user base and more will do the same. We have already seen some large deals in the industry, with more expected with economic recovery.The materialization of these growth factors accentuates the plausibility of the moderate impact scenario. While cannibalization is expected to be limited in most markets, telecom companies should count on the emergence of a new set of strong challengers with the potential to cause major upset.Telecom operators must adjust their strategy to a world of OTT presenceThe second phase of VoIP innovation with mVoIP in the forefront is led by more sophisticated players, increasingly positioned to

telecoms, on the other hand, employ a different strategic approach towards OTT. They have been using VoIP to enter markets, and to strengthen their market positioning by using partnerships with OTT players as means of differentiation (Figure 3). Regulator attitude towards OTT varies depending on the stage of development in the country. In developed countries, such as the US, the EU and Japan, regulators enforce net neutrality, and promote openness and lack of discrimination. In contrast, some less developed countries have ruled against voice OTT. For instance, in the Middle East, many governments have blocked Skype. However, the ban on using mVoIP software in UAE was recently lifted by the regulatory authority to promote cheaper voice. In China, VoIP (PC-to-phone) is classified as a basic voice call service, thus only major operators with basic telecom service licenses are allowed to provide mVoIP services. Going forward, regulators in developed countries are expected to focus on ensuring net neutrality and third party access. Some less developed countries with public telecom services or that recognize substantial income from international termination are more likely to regulate against OTT players in near term. However, in the long run, we expect most countries to shift towards increased net neutrality.Mobile voice OTT has considerable growth potentialArthur D. Little has conducted in-depth analysis of OTT’s growth potential based on interviews with more than 50 telecom and OTT CxOs globally. Based on this research, Arthur D. Little developed three main market scenarios based on the above-stated growth factors: negligible impact, moderate impact and major impact (Figure 4).Negligible impact This scenario assumes continued weak macroeconomic conditions worldwide, resulting in a slower growth rate of mobile broadband and a lower penetration rate of mobile smart devices. Operators globally move away from flat fee data bundles and OTT players struggle to monetize their user base and continue to disappoint in terms of voice quality and user experience. As standard circuit-switched call rates continue to decline, most users do not care to arbitrage on voice. Investors will be cautious on investment in the industry. Operators can and will take measures to block or hinder OTT progress indirectly mandated by regulator inattention, even though limited partnerships and co-branding initiatives may prevail.In this scenario, Arthur D. Little forecasts mobile VoIP to still experience high growth albeit from a low base, growing from $1 billion in 2011 to $14 billion in 2016 (Figure 5). Still, it is forecasted to only represent a negligible 2 percent of total mobile voice revenues globally in 2016. Moderate impact Assuming that mobile broadband, smart devices and flat fee penetration in both developed and emerging markets will continue to grow at the same pace or slightly faster than today, mVoIP will have moderate impact. OTT would offer acceptable voice quality and persist in integrating their services seamlessly as a part of larger user experience, partnering with both major challenger operators and key players in other businesses such as social media, gaming and dating (e.g. MSN, Facebook, Match.com). Major players such as Microsoft, Google and Apple along with a range of smaller players enforce their interest in this market and find sustainable ways to monetize their user base. Investors’ appetite for the industry improves along with the overall economy. Regulators pay some attention to the non-discrimination of the industry in their efforts to promote net-neutrality. Selected customer segments in emerging markets leapfrog quickly into mobile voice OTT when mobile broadband is available while some developed telecom markets that lag in new trend adoptions start adopting OTT solutions with some delay. In this scenario, Arthur D. Little forecasts mVoIP to grow to nearly $60 billion in 2016 amounting to 10 percent of total mobile voice revenues. Cannibalization from traditional voice traffic is expected to remain limited. Major impact This scenario assumes the accelerated growth rate of mobile broadband and smart devices penetration, as well as data flat fees. Various sustainable partnerships have been developed with operators globally, including key incumbents. Significant innovations and technical improvements allow for HD voice quality with enhanced customer experience and successful monetization of voice OTT user base, such as through the successful launch and adoption of B2B OTT solutions. OTT companies continue to innovate, regularly offering customer sweet-spot functionality. Major success cases emerge, including Skype-Microsoft, to prove the concept for investors. Players gain control of a major or all parts of OTT value chain and attract substantial capital from early and growth stage investors. According to Arthur D. Little, this scenario could result in market growth from $1 billion in 2011 to more than $100 billion in 2016, with OTT claiming a high share of net new minutes of traffic added. Amounting to 20 percent of total mobile voice revenues, this scenario illustrates a disruptive potential from OTT. Such scenario would require both high volume growth and radically improved monetization performance by OTT players. Even in today’s bleak economic environment, smartphone and mobile broadband penetration is expected to continue to increase globally. Despite declining circuit-switched voice rates due to decreasing termination rates and increased bundling, there will still be arbitrage opportunities in voice. QoS remains an issue, though the quality gap vis-à-vis circuit-switched is expected to diminish by 2016. Call quality of Skype and Google Voice is improving and today in some markets is nearing that of circuit-switched. OTT players are increasingly partnering with telecom companies and social media to find ways to market and integrate voice as part of larger user experience. Many players have already moved to freemium models to monetize their user base and more will do the same. We have already seen some large deals in the industry, with more expected with economic recovery.The materialization of these growth factors accentuates the plausibility of the moderate impact scenario. While cannibalization is expected to be limited in most markets, telecom companies should count on the emergence of a new set of strong challengers with the potential to cause major upset.Telecom operators must adjust their strategy to a world of OTT presenceThe second phase of VoIP innovation with mVoIP in the forefront is led by more sophisticated players, increasingly positioned to

attack the most fundamental model upon which carriers base their business. Their innovations will make the coming years challenging and unpredictable for telecom companies globally. In all scenarios, mVoIP will show considerable growth, albeit from a low base, and could potentially cause disruption, threatening traditional operator revenues. Complacent telecom players face the risk of losing significant revenues and market share to these emerging challengers. Alternatively, OTT mVoIP may be an opportunity to enhance customer experience, broaden range of services, enable the operator to position itself as an innovator, limit risk and investments in content production, and extend the market reach. Consequently, it is time for telecoms to act.

Market leaders: Market leaders, including incumbents, can hinder the development of mobile VoIP by controlling the customer perceived relationship between voice and data spend in smart bundles and cross-subsidize with a range of services. Market leaders could also start, buy or partner to launch their own VoIP services or even counter VoIP by adjusting voice and data tariffs (like Telefonica with JaJah or Telenor with Comoyo).

Challengers: Challengers could partner with OTT companies and use the customer appeal of OTT innovative features as an effective customer acquisition tool to enter markets. Part-nerships with OTTs can also serve as means of differentiation and help challengers strengthen their market positioning. Whatever the strategy, the success and sustainability of the chosen move will be partially determined by the telecom player’s market position, as well as the business and legal context of individual markets.

Telecoms need to prepare their strategy carefully to support business models that are sustainable, profitable and deliver a competitive advantage. Arthur D. Little has the experience, expertise and methodology to help telcos formulate a robust strategy in terms of evaluating their response towards OTT players. This includes assessment of appropriate value chain positioning, evaluation of complementary service offering compared to OTTs and evaluation of potential OTT partnerships, allowing telcos to arrive at an optimal strategy in these turbulent times.