ICT spending in Qatar is set to grow at a compound annual growth rate (CAGR) of 9.2% during the period 2019-2024, to reach US$9bn by 2024. Growth will be moved forward by the development of large-scale, infrastructure-driven and government-led projects in the transportation, energy and construction sectors, says GlobalData, a leading data, and analytics company.

GlobalData predicts that the software market in Qatar will reach US$1.8bn, while the hardware market will reach $2.5bn by the end of 2024. IT services are expected to account for more than 52% of the total ICT spending and will reach $5bn by the end of 2024.

Pramod Agrawal, Senior Technology Analyst at GlobalData, comments: “Qatar is moving towards a knowledge-based economy and is making investments in state-of-the-art ICT infrastructure, skills development and e-government in line with the Qatar National Vision 2030. These efforts will enable Qatar to position itself as one of the leading dynamic and fast-growing economies in the region.”

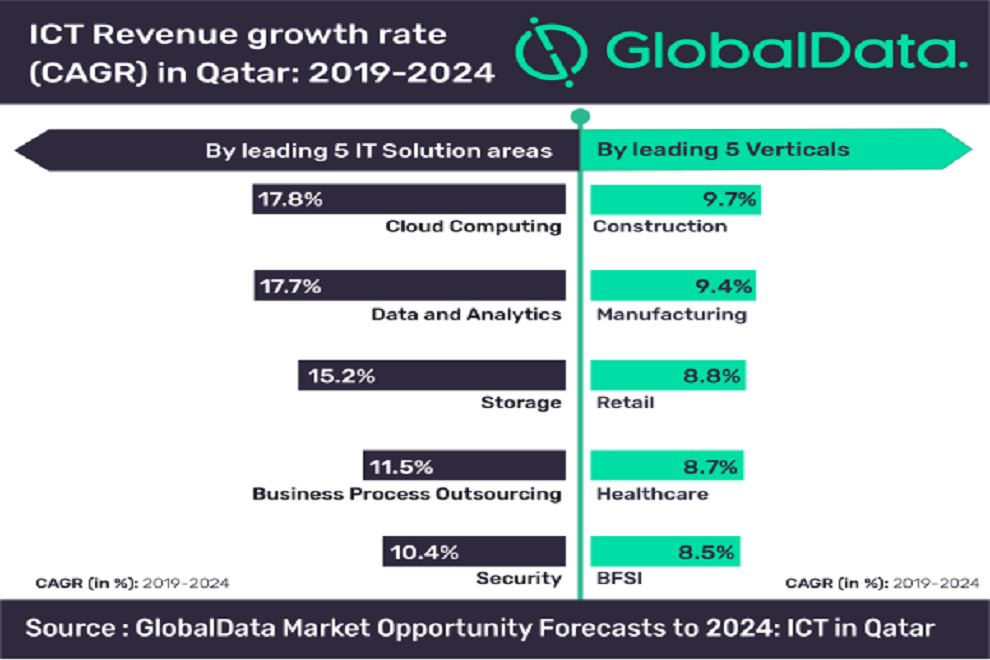

Cloud computing revenues in Qatar are estimated to witness the highest growth rate (CAGR) of 17.8% during the forecast period to reach US$1.6bn. Within cloud computing, software as a service (SaaS), the largest segment, will grow by a CAGR of 17.5% during the same period, mainly driven by Qatari organizations shifting from traditional on-premise software deployments to cloud-based models.

Growth in the IT services market in Qatar will be driven by the construction and manufacturing verticals. The banking, financial services, and insurance (BFSI), retail and healthcare sectors are also amongst the fastest-growing verticals (in terms of CAGR) during the forecast period.

IctQATAR, the country’s telecommunications regulator and the government’s technology advocate and facilitator in the transformation of Qatar’s IT landscape, has identified several strategies to encourage specific ICT development and key investment opportunities over the coming three to five years. The strategy aims to build major infrastructure projects such as the new Doha Port, Lusail City (also known as ‘Qatar’s Future City’) to be completed in 2020, and FIFA 2022 initiatives, which will have a positive impact on the growth of the ICT sector.

Agrawal concludes: “Technological advancements in Internet of Things (IoT), big data analytics, cloud computing and artificial intelligence (AI) will continue to spur growth in the IT business. However, Qatar–Saudi Arabia diplomatic conflict and the relatively lower maturity of ICT services are challenges that Qatar will have to overcome.”