Kenya’s overall mobile phone market grew 15.0% quarter on quarter (QoQ) in Q4 2020, with smartphone shipments increasing 11.3% and feature phone shipments up 20.8%. That’s according to the latest edition of IDC’s Worldwide Quarterly Mobile Phone Tracker, which reveals that the overall market declined 2.0% year on year in 2020. Feature phone shipments were down 8.7% YoY for the year as a whole, while smartphone shipments increased 3.3%.

The high growth in Q4 2020 was spurred by aggressive marketing and advertising campaigns, Christmas offers, and Black Friday promotions. Other market drivers included the reduction of VAT to 14% and the PAYE exemption for low-income earners, which resulted in greater disposable income for consumers.

Smartphones accounted for 59.0% of total mobile phone shipments in Q4 2020, with major vendors successfully launching new models during the quarter. Demand stemmed from the growing need to engage with online services access, a need that was accelerated by the COVID-19 pandemic. Tecno led the smartphone space in Q4 2020 with 30.7% share of total shipments. Samsung garnered 14.0% share, while Huawei accounted for 10.2% of the market. Safaricom, with the market’s most affordable Neon model, placed fourth with 8.4% unit share.

Feature phones made up 41.0% of total mobile phone shipments in Q4 2020. Feature phones remain within easy reach for most consumers owing to their low average selling price (ASP). They are also the preferred secondary device among consumers due to their long battery lives. The major players in the feature phone space were Nokia with 44.5% share, Itel with 29.3% share, and Tecno with 24.8% share.

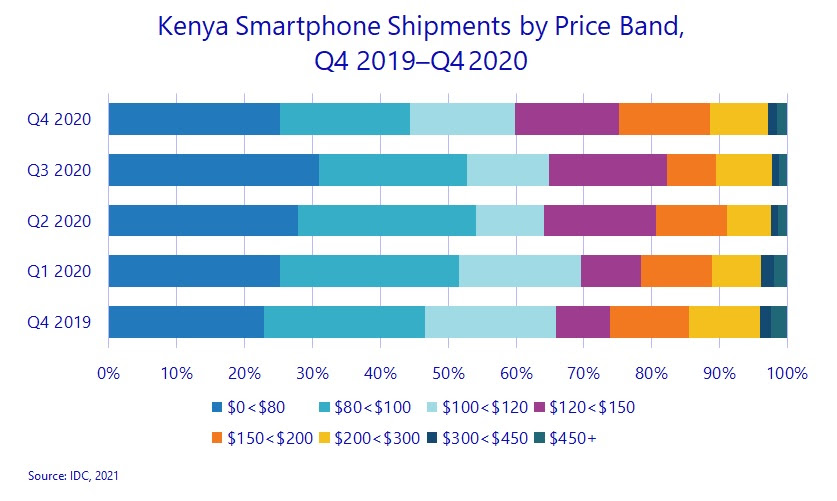

The ASP for smartphones grew 5.2% QoQ in Q4 2020, primarily due to the launch of new devices in the midrange and premium end of the market and a shift towards larger screen sizes. Shipments of devices in the lowest price band ($0<$100) declined during the quarter as major vendors switched their attention to the higher end of the market, which led to lower-than-expected sales volumes being realized at the low end. While the $100-$150 price band’s share of the market remained relatively stable, the share of the $150-$300 band grew on the back of the new launches.

Looking ahead, IDC forecasts YoY smartphone market growth of 1.4% for 2021. Anticipated supply constraints for components will negatively impact the consumer market in the first half year, with recovery postponed to the second half year.

“While 5G-enabled devices will sustain a growing trend throughout the year, they will remain minor in terms of actual shipment numbers,” says George Mbuthia, a research analyst at IDC. “5G models will be launched in the midrange and premium price bands, leading to small unit volumes in the market. Going forward, the proliferation of 5G devices in the smartphone segment, increased competition, and improved international connectivity will see the market undergo considerable changes in terms of 5G infrastructure development.”