Nigeria’s smartphone market grew 2.0% in unit terms quarter on quarter (QoQ) in Q2 2021, according to the latest figures from global technology and consulting services firm International Data Corporation (IDC). However, the firm’s Quarterly Global Mobile Phone Tracker also shows that feature phone shipments into the country declined 6.4% over the same period. Feature phones accounted for 51.8% of the market’s overall shipments in Q2 2021, with smartphones responsible for the remaining 48.2% share.

The smartphone market’s growth in Q2 2021 was spurred by vendors launching various new models, increasing their investments in marketing activities, and shifting their product portfolios towards entry-level and mid-range devices. Transsion’s Tecno, Itel, and Infinix brands dominated the country’s smartphone market in Q2 2021 with 76.9% unit share. Samsung placed second with 10.0% share, while Nokia and Xiaomi followed with respective shares of 3.7% and 2.9%.

With many consumers continuing to prefer physical stalls, smartphones sales through offline retail channels grew 1.7% QoQ in Q1 2021. However, smartphone sales through online channels grew 7.8% over the same period as e-tailers in the country improved their delivery capabilities, facilitated secure payments, and capitalized on improved consumer confidence.

Feature phones continue to be the preferred secondary device in the Nigerian market, mainly due to slow infrastructure development and the country experiencing constant power outages. The major players in the feature phone space in Q2 2021 were Tecno with 45.8% unit share, Itel (35.1%), and Nokia (12.7%). Feature phone shipments declined as the devices now face stiff competition from ultra-low-end smartphones in the <$100 price segment, whose affordability makes them more attractive to consumers. The transition from feature phones to smartphones is also accelerating as a result of more consumers demanding access to the Internet.

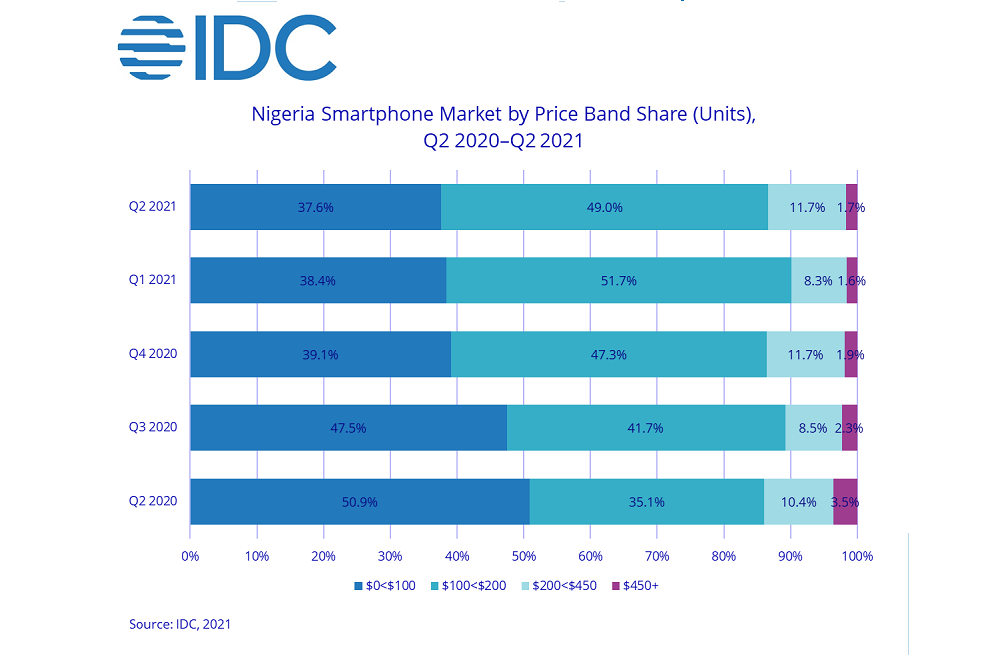

“With reduced consumer purchasing power due to the repercussions of the COVID-19 pandemic, the entry-level <$200 segment of the smartphone market continued to lead the way in Q2 2021 with 86.7% unit share,” says George Mbuthia, a research analyst with IDC. “The affordability of these models, together with improvements in core features such as larger storage, better battery life, and bigger screen sizes, led to an increase in sales during the quarter. Transsion and Samsung were particularly successful in capturing greater market share by launching new models into this rewarding market segment.”

IDC expects Nigeria’s overall mobile phone market to decline 7.0% QoQ in Q3 2021, with feature phone shipments declining 6.0% and smartphone shipments declining 8.0%. This is due to the existence of large inventories following high levels of shipments during the first half of the year and the fact that borders remain closed, thereby hindering cross-border trade. “The global chip shortage will also affect the market, although there is still uncertainty over the scale of its impact,” says Dr. Ramazan Yavuz, a senior research manager at IDC. “Despite the anticipated negative impact of the chip shortage, the Nigerian market will rebound somewhat in Q4 2021, with demand spurred by Black Friday and the festive period in November and December.”