Zain Group announces an investment in ZoodPay, ‘Buy Now Pay Later’ (BNPL) Super App’s series B US$38 million fundraising through its venture capital arm ‘Zain Ventures’, joining other global and existing investors in the round.

Zain Ventures will work closely with the teams of ZoodPay’s fintech solution and its demand generation marketplace ZoodMall to accelerate their growth and expansion across the region, stimulating local and cross-border e-commerce transactions, boosting socio-economic activity and creating jobs.

Headquartered in Switzerland, the ZoodPay & ZoodMall app already has more than 8 million users and ten offices across the Middle East and Central Asia. The business commits to delivering a “Swiss quality” shopping experience and cross-border services to merchants and shoppers across fast-growing fintech and e-commerce emerging markets such as Iraq, Jordan, Lebanon, Uzbekistan, and Kazakhstan.

ZoodPay’s Super App BNPL fintech solution offers ZoodMall online and offline shoppers in core geographies convenient options and instant approval to buy products in their local currency in cash or with the flexibility of paying in four to six monthly installments, without any interest or fees.

ZoodMall is the Middle East and Central Asia’s fastest-growing mobile-only marketplace, providing consumers

access to 7 million products from over 30,000 local and cross-border merchants.

A statement from Zain Group noted, “The ZoodPay Super App and its marketplace ZoodMall offers an attractive, convenient, and unique value-proposition to digital-savvy online shoppers and the underbanked population across Zain’s markets, supporting the company’s ‘4Sight’ strategic Fintech and digital lifestyle aspirations to customers and beyond. Zain is confident this strategic investment will be value-accretive to Zain Ventures on multiple fronts as the team works closely with the successful ZoodPay team on accelerating its growth and expansion across our footprint.”

A statement from OrientSwiss, the parent company of ZoodPay and ZoodMall noted, “As local and cross-border e-commerce grows, partnering with dynamic companies such as Zain will be a positive boost for all stakeholders in the ecosystem, whether they be customers, merchants or investors. OrientSwiss would like to thank the Zain Ventures management team and other investors for their trust and confidence, and looks forward to taking the ZoodPay Super App ecosystem to new heights.”

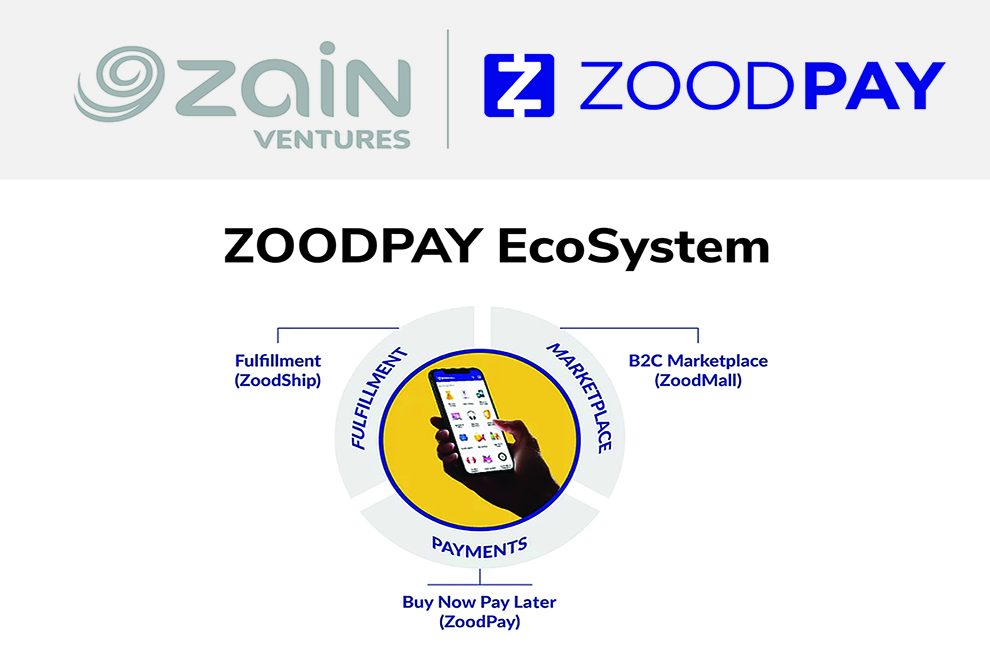

ZoodPay’s Buy Now Pay Later Super App also encompasses the ZoodMall marketplace, and the logistics cross-border corridor, ZoodShip. This ecosystem empowers and incentivizes merchants from the Middle East, Central Asia, China, Europe, Russia, and Turkey to open their storefronts to local, new low-penetrated and fast-growing markets without additional set-up costs or fees. Merchants have a unique one-stop value proposition offer to shoppers, supporting them in gaining new customers (including the underbanked) with higher-order value and building brand loyalty by offering:

1. Secure, flexible, and popular payment methods either by cash or through ZoodPay’s BNPL solution

2. Creating demand generation and marketing for products through the ZoodMall B2C marketplace

3. Full-operational logistics support for delivery and customer support to reduce product returns.

Millions of shoppers across the globe now use a Buy Now Pay Later (BNPL) platform (also known as point-of- sale loans or lay-by) to finance their online or in certain cases, offline purchases. BNPL provides the option for shoppers to receive their items immediately and pay over a period of installments, often interest free with just a few clicks when checking out. Shoppers typically have a down payment and then pay the remaining sum in installments during a period that can range from two weeks to three months, or longer in certain instances.

The advantage for shoppers is that they can buy a more expensive item than they might normally be able to pay for in one go, say a mobile phone for US$500, and spread the cost of their purchase over weekly or monthly installments.

COVID-19 accelerated the growth of online shopping, and BNPL platforms which had been popular and growing prior to the pandemic, benefited exponentially due to the change in consumer spending habits and fast-growing e-commerce adoption.

According to a report from Worldpay, a payment processing firm, global e-commerce transactions totaled $4.6 trillion in 2020, up 19% from 2019. Worldpay states that BNPL accounted for 2.1%, or about $97 billion of all global e-commerce transactions in 2020 and this figure is expected to double to 4.2% by 2024.