The Middle East, Turkey, and Africa (META) smart home devices market continues to register significant gains on the back of increasing demand and better supply in the region. That’s according to the latest insights from International Data Corporation (IDC), with the firm’s newly updated Worldwide Quarterly Smart Home Devices Tracker showing that 8.73 million smart home devices were shipped across the META region in Q3 2022, up 35.1% year on year.

IDC defines the smart home as “a home or residential dwelling equipped with electronic devices that can communicate bidirectionally and autonomously using IP connectivity.” The requirements for autonomous and bidirectional communications over an IP network are meant to exclude dumb devices that act as passive relays for data and/or cannot be controlled by or communicate with a remote user. The smart home is a subset of the larger Internet of Things (IoT) market.

“More and more end users are realizing the benefits of installing smart devices in their homes, which is driving demand across the region,” says Isaac T. Ngatia, a senior research analyst at IDC. “At the same time, more vendors are entering the market and the channel has expanded, with more retail outlets now stocking smart home devices. Indeed, as demand for smartphones, tablets, and PCs declines, some retailers have expanded their portfolios to include smart home devices. Hence, the market’s growth is being driven by increases in both demand and supply.”

The smart entertainment category, especially smart TVs, was the key volume mover in Q3 2022, accounting for 66.7% of total devices shipped to the region. Other product categories that witnessed significant growth during the quarter included home monitoring and security, smart lighting, and smart appliances. The growing range of vendors and products in these three categories has been instrumental in driving the volume and value of such devices across the region. The three categories experienced a 58.0% quarter on quarter growth in volume, in Q3 2022 compared to the previous quarter.

“The proliferation and ease of use of Wi-Fi as the de facto way for connecting devices to the internet is enabling more and more end users to venture into this space,” says Ngatia. “The introduction of 5G, particularly across the Gulf Cooperation Council (GCC) region, and the uptake of 4G in most other countries within the META region have also contributed to the growth of this market. However, as is the case elsewhere in the world, interoperability between smart homes devices from different vendors remains a challenge.

“The concerted efforts of players within the smart home devices market to raise awareness and enhance the user experience is bearing fruit across the META region. End users are increasingly making the transition from affordable devices such as smart lights to more expensive devices such as large home appliances, and we are seeing an increase in supply to meet rising demand.”

IDC notes that end users are increasingly realizing the added convenience of the “smart home” concept in enhancing their day-to-day lives. As a result, the uptake of different product categories varies across the region depending on prevalent lifestyles. “Turkey, for example, is seeing high uptake of smart home appliances such as smart robotic vacuums, driven not only by availability and affordability, but also by lifestyle choices,” says Ngatia. “The average household in Turkey does not have an in-home cleaner, making robotic vacuum cleaners particularly attractive. This contrasts with the Gulf region, where home cleaning services are readily available, hence the demand for robotic vacuum cleaners is not as high.”

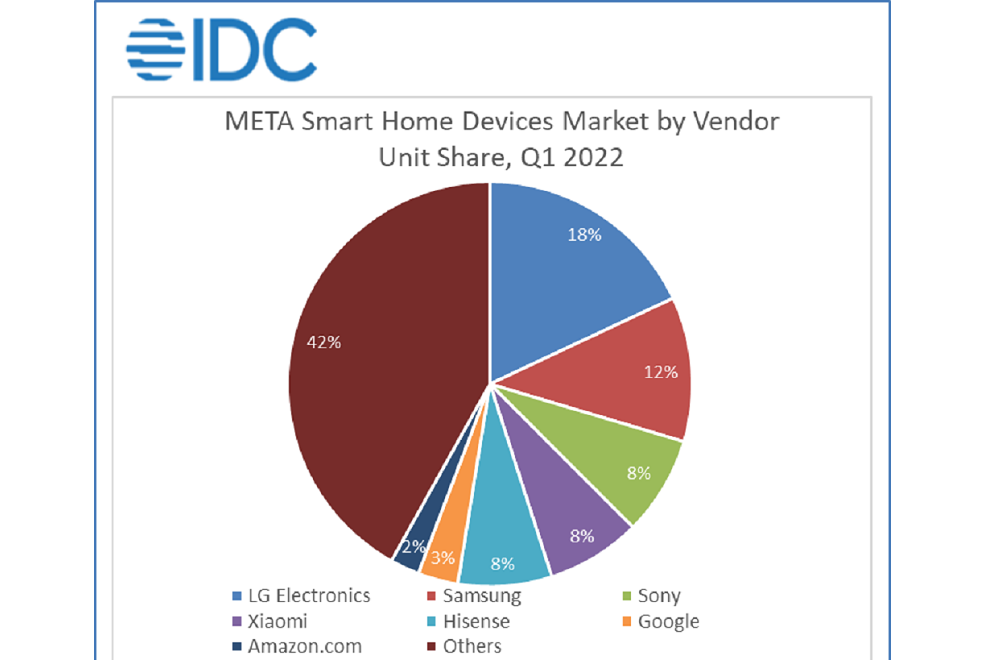

The market is home to a wide array of vendors, although some of these specialize in only one category. The region is seeing an increasing influx of vendors battling to grab share in the overall market. Some of the leading brands in the region include Amazon, Eufy, Google, Honeywell, IKEA, iRobot, LG Electronics, Nest, Ring, Samsung, and Xiaomi.

IDC tracks different categories of smart home devices, including smart appliances, smart home monitoring / security devices, smart lighting, smart speaker, smart thermostat, and smart video entertainment.