e& is one of the world’s leading technology and investment conglomerates, and MoneyGram International, a global leader in the evolution of digital peer-to-peer (P2P) payments, today announced an expansion of their strategic partnership enabling e &’s large and fast-growing customer base of 160 million to send and receive money through mobile wallets across its footprint in near real-time.

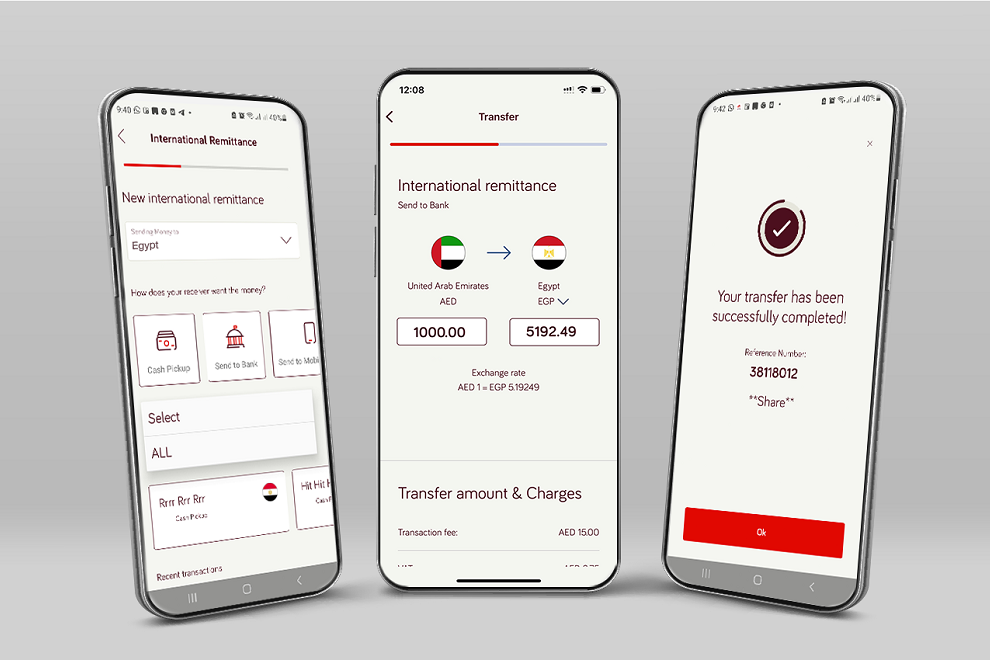

In the UAE, e& money, the fintech arm of e& life has been partnering with MoneyGram for international remittance service. This agreement solidifies e&’s global aspirations across its other markets to offer customers the most inclusive financial services powered by a seamless experience.

Through mobile wallet app customers in e& international markets can send and receive money globally quickly and effortlessly due to the efficient transactional process offered by MoneyGram. The wallet-to-wallet proposition also amplifies a seamless digital financial experience, given the rapidly evolving customer payment behaviours and the accelerated adoption of contactless payment solutions.

Mikhail Gerchuk, CEO, e& international said: “As more people across the world embrace digital financial services, we are continuously seeking new ways to empower our customers with the best solutions, and embark on value-adding partnerships that help them to access financial services quickly and easily. International money transfer is a crucial service that enables our customers across our footprint to send and receive money from their families, given the large expat population living in the markets where we operate.

Through MoneyGram’s expansive network of mobile wallet operators, bank account and card deposit services, and retail locations, customers around the world have the ability to choose how to send and receive money based on their unique requirements. The service has been live throughout UAE and Afghanistan, with Egypt, Pakistan, Saudi Arabia and several other e& international markets in Africa expected to launch in the next few months.

Khalifa Al Shamsi, CEO, e& life, said: “We have always aimed to revolutionise customer experience through innovative solutions that help meet the financial needs of our customers. The strategic partnership with MoneyGram has been enabling us continue building this solid foundation of growth, adding to the array of financial products and services that enhance and add value to our customers’ lives. We will continue to work with MoneyGram and its vast network for the benefit of e& money subscribers while addressing the growing demand for a financial super app marketplace.”

“As a result of our strategy to invest in our digital network that now extends to over 100 countries, we’re seeing increased demand to access our global platform. As more digital partners seek to embed our leading fintech capabilities into their service offerings, we see a significant growth opportunity to efficiently add transactions to our scalable platform,” said Alex Holmes, MoneyGram Chairman and CEO. “Our collaborative relationship with e& has grown to become one of our strongest and more successful digital partnerships. We’re thrilled to continue to expand our relationship as their preferred partner for cross-border payments across all of the 16 markets in which they operate.”