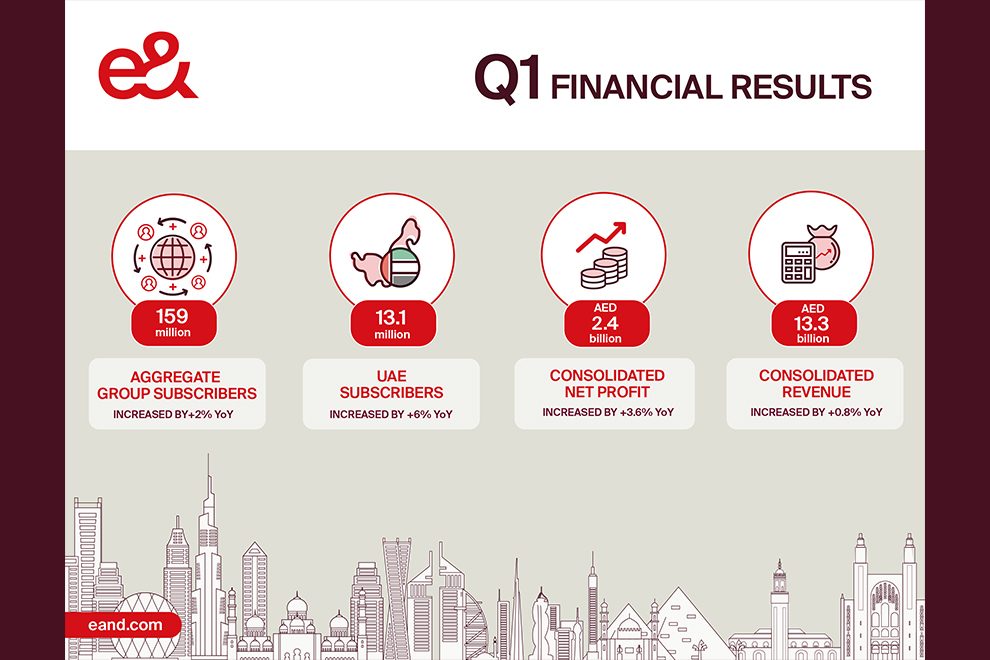

Financial Highlights for Q1 2022

| Q1 2022 | Q1 2021 | percent change | |

| Revenue | AED 13.3 bn | AED 13.2 bn | +0.8%(*) |

| Net Profit | AED 2.4 bn | AED 2.3 bn | +3.6% |

| EBITDA | AED 6.8 bn | AED 6.8 bn | +0.5%(*) |

| Earnings per Share | AED 0.28 | AED 0.27 | +3.6% |

| Aggregate Group subscribers | 159 million | 156 million | +2% |

e& (formerly known as Etisalat Group) has announced its financial results for Q1 2022. (*)At constant exchange rates, revenue increased by 3.5 percent and EBITDA increased by 2.8 percent year-over-year.

Key operational highlights and Developments for Q1 2022

e&:

> Named the world’s strongest telecom brand, the first in the Middle East to achieve global recognition by Brand Finance

> e& shareholders approved to distribute a full year cash dividend of 80 fils per share for the fiscal year 2021 at the General Assembly Meeting held on 5 April 2022

> Completed the acquisition of elGrocer, under the Smiles brand

> Entered a new phase of collaboration and strategic partnership with Microsoft to drive innovation and digital transformation

> Partnered with Meta to drive innovation with enhanced Augmented Reality (AR) and Virtual Reality (VR) experiences and conversational commerce in its digital communication projects

> Announced discussions with Mobily regarding a potential offer to increase its shareholding in Mobily

> Etisalat Misr and Honeywell signed an MoU to offer new services and products in the field of IoT and smart cities

> e&, Abu Dhabi Digital Authority (ADDA) and Trend Micro partnered to launch Cyber Eye, an initiative designed to strengthen the Abu Dhabi Government entities’ cybersecurity capabilities

- Etisalat UAE, from e&:

- Launched the UAE’s first of its kind Easy Insurance, an innovative insurance platform offering digital services for auto, health and travel insurance

- Recognised outstanding small and medium businesses (SMBs) and start-ups at the second edition of the SMB awards

- Expanded collaboration with Amazon Web Services (AWS) to serve key industries and meet the growing demand for digitalisation across different industries

- e& life, from e&:

- E-Vision, owned by e&, and Abu Dhabi Developmental Holding Company PJSC (ADQ), signed a binding agreement to acquire approximately 57 percent in STARZPLAY ARABIA

- ejunior, owned by E-Vision, celebrated its successful 21-year journey in the UAE

- e& enterprise, from e&:

- Partnered with NICE to bring the CXone cloud platform to the UAE

- Collaborated with Oracle, to host business solutions for Transguard Group to lower the total cost of ownership (TCO) by over 40 percent in five years

Overview

e&’s first quarter consolidated revenues increased by 0.8 percent to AED 13.3 billion, while consolidated net profit increased to AED 2.4 billion, a year-over-year increase of 3.6 percent. Consolidated EBITDA reached AED 6.8 billion, an increase of 0.5 percent year-over-year, resulting in an EBITDA margin of 51 percent. At constant exchange rates, revenue increased by 3.5 percent and EBITDA increased by 2.8 percent year-over-year.

The number of Etisalat UAE subscribers reached 13.1 million in Q1 2022, while aggregate group subscribers reached 159 million, representing an increase of 2 percent over the same period last year.

“e& delivered strong financial performance across all key metrics, driven by higher demand for digital and data services and the Group’s ability to leverage superior networks”

Outlook

Since e&’s evolution into a global technology and investment conglomerate earlier this year, the company has maintained solid performance by creating innovative solutions for various customer segments and targeted acquisitions and value-creation partnerships for the benefit of consumers, businesses and societies.

Commenting on the Q1 2022 results, Hatem Dowidar, Group CEO of e&, said: “Our first quarter results are a testament to the effectiveness with which we have begun the new chapter of our journey as a global technology and investment conglomerate that digitally empowers societies.

“We will continue to explore new avenues of growth, expand our offerings, enhance the quality of our solutions, forge new partnerships, and launch a number of digital initiatives to support SMBs, governments and large enterprises. All of this stems from our clear vision to create a more progressive business model, represented by the Group’s business pillars, so that we can seize the opportunities that arise in an increasingly fast-paced digitalised business landscape.

“We are grateful to the vision of the UAE leadership for their continued support, especially as we serve our customer segments by remaining agile across our businesses, investing in future technologies, and delivering innovative solutions that matter. We will continue our mission to accelerate digital transformation in a way that positively impacts businesses and people’s lives at every digital touchpoint, while maximising value creation for our shareholders.”

Etisalat Group recently changed its brand identity to e&. This is in line with the organisation’s strategy to accelerate growth by creating a resilient business model that is represented by its key business pillars.

The telecommunications business currently continues to be operated by Etisalat UAE in e&’s home market and by its existing subsidiaries for international operations, upholding the Group’s rich telecommunications heritage, strengthening its strong telecommunications network and maximising value for the Group’s various customer segments.

Ramping up the digital services for individual customers to elevate their digital-first lifestyle, e& life brings next-generation technologies through smart connectivity platforms in entertainment, retail and financial technology.

To enable the digital transformation of governments, large-scale enterprises and corporates, e& enterprise focuses on maximising value through its end-to-end solutions in cybersecurity, cloud, Internet of Things (IoT) and Artificial Intelligence (AI), as well as deploying mega projects. e& capital allows the Group to focus its efforts on driving new mergers and acquisitions while maximising shareholder value and strengthening global presence.