● The combination will bring together complementary capabilities to create a UAE-based space technology champion with an implied market capitalization of over AED 15 billion (over USD 4 billion), based on both entities’ closing share prices as of December 18, 2023, and a free float of

21%, with further significant upside potential for revenue growth and synergies

● The combined entity will create a vertically integrated leading provider of AI-powered geospatial and mobility solutions, satellite communications and business intelligence

● The merger will establish a platform for transformative technologies to enable space-based services with significant impact on societies and economies

● The combined entity will yield considerable revenue synergies and economies of scale, and will best position the organisation for innovation and profitable growth

Bayanat and Yahsat have announced today that their respective Boards of Directors have unanimously voted to recommend to shareholders a merger of the two Abu Dhabi-headquartered and ADX-listed entities.

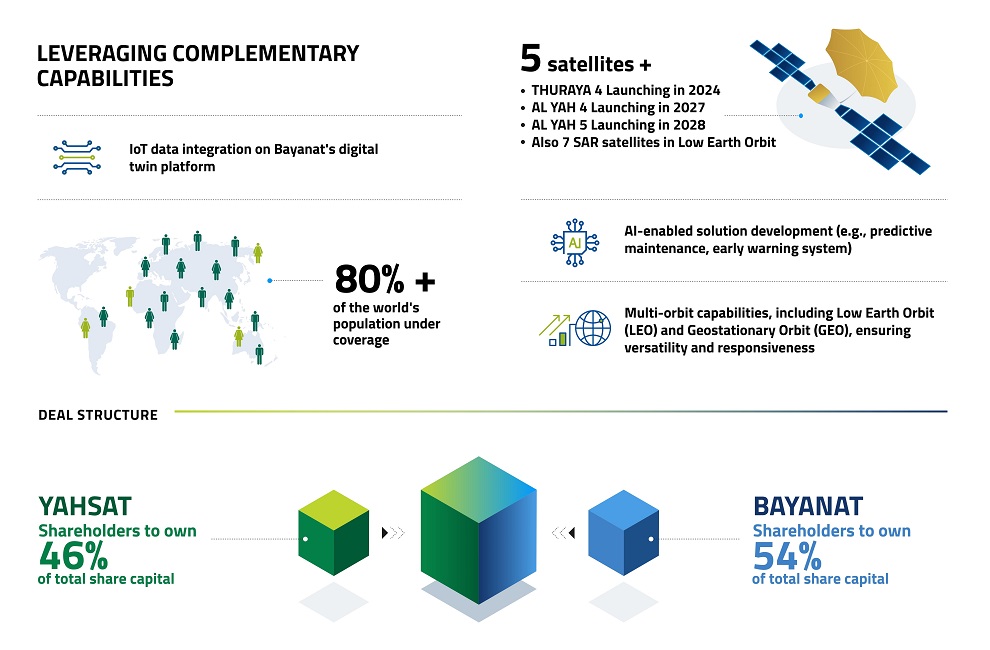

The proposed merger will create an AI-powered space technology champion in the MENA region with an implied market capitalization of over AED 15 billion (over USD 4 billion), based on both entities’ closing share prices as of December 18, 2023, the last day of trading prior to the announcement of the merger. This would make it one of the most valuable publicly listed space companies in the world by market capitalization, with additional potential for significant global growth and synergies. The combined entity will be vertically integrated and optimally positioned to capture regional and international opportunities in geospatial and mobility solutions, satellite communications, and business intelligence. With a strengthened financial position, enhanced AI-powered technological capabilities, and a diversified product portfolio, the combination will also establish a platform for transformative technologies to enable space-based services with significant impact on societies and economies. It is also expected to benefit from considerable revenue synergies and economies of scale that will best position the organization for innovation and profitable growth.

The proposed transaction will be executed through a share swap with Bayanat, the remaining legal entity. Bayanat shareholders will own approximately 54% and Yahsat shareholders approximately 46% of the combined entity. Bayanat and Yahsat have each, in line with international best practice, obtained independent fairness opinions from Houlihan Lokey and FTI Capital Advisors (respectively). Group 42 (G42), Mubadala Investment Company (Mubadala), and International Holding Company (IHC) will own approximately 42%, 29% and 8% of the combined entity respectively.

H.E. Tareq Al Hosani, Chairman of Bayanat, said: “This merger will unite two leading home-grown companies to create the MENA region’s first AI-powered space technology company. Leveraging our complementary assets, capabilities, and ambitions will allow us to expand across the space value chain and offer unparalleled service to our combined customer base. Together, we will leverage our key synergies to reinforce our position as a key engine of growth and strategic solutions provider to the UAE government and its agencies, while expanding our reach to global customers.”

Musabbeh Al Kaabi, Chairman of Yahsat, said: “The merger is a compelling opportunity to amplify value creation for shareholders, utilizing synergies and strategic consolidation to create a technologically advanced champion, further reinforcing the UAE’s position as a leader in the AI and space sectors. The enlarged entity will benefit from accelerated growth potential as a player of scale with enhanced competitive advantage. This growth will be driven by our access to high-growth markets via cutting-edge technologies and an increased base of local and global customers, in addition to strong financials that allow us to pursue more ambitious growth opportunities. We look forward to working together for the realisation of our shared ambition.”

The merger is subject to a number of conditions, including regulatory approvals from governmental authorities, including the Securities and Commodities Authority and the ADGM Registration Authority, and the approval of shareholders representing 75% of the voting rights present and voting at a quorate general assembly meeting of each of Bayanat and Yahsat.

Bayanat and Yahsat will continue to operate independently until the merger is effective, which is expected to take place in the second half of 2024.