The total mobile service revenue in Malaysia is poised to increase at a compounded annual growth rate (CAGR) of 2.3% from $5.3 billion in 2023 to US$6.0 billion in 2028, primarily driven by the mobile data services segment, according to GlobalData, a leading data and analytics company.

GlobalData’s latest Malaysia Mobile Broadband Forecast (Q2 2023) indicates that the growth in mobile data service revenue will offset the decline in mobile voice service revenue during the forecast period and prevent any deep erosion in the overall mobile service revenue.

While the mobile voice revenue will decline at a CAGR of 2.3% between 2023 and 2028, mainly due to the widespread consumer shift towards the OTT communication platforms and the subsequent decline in mobile voice ARPU, mobile data service revenue will increase at a CAGR of 4.1% over the same period, driven by 5G network expansions and the subsequent rise in the adoption of higher ARPU-yielding 5G services.

Sarwat Zeeshan, Telecom Analyst at GlobalData, comments: “The average monthly mobile data usage in Malaysia is expected to increase from 19.4 GB in 2023 to 44.4 GB in 2028, driven by the growing consumption of online video and social media content over smartphones, thanks to the growing availability and adoption of 4G and 5G services and data-centric plans offered by MNOs.”

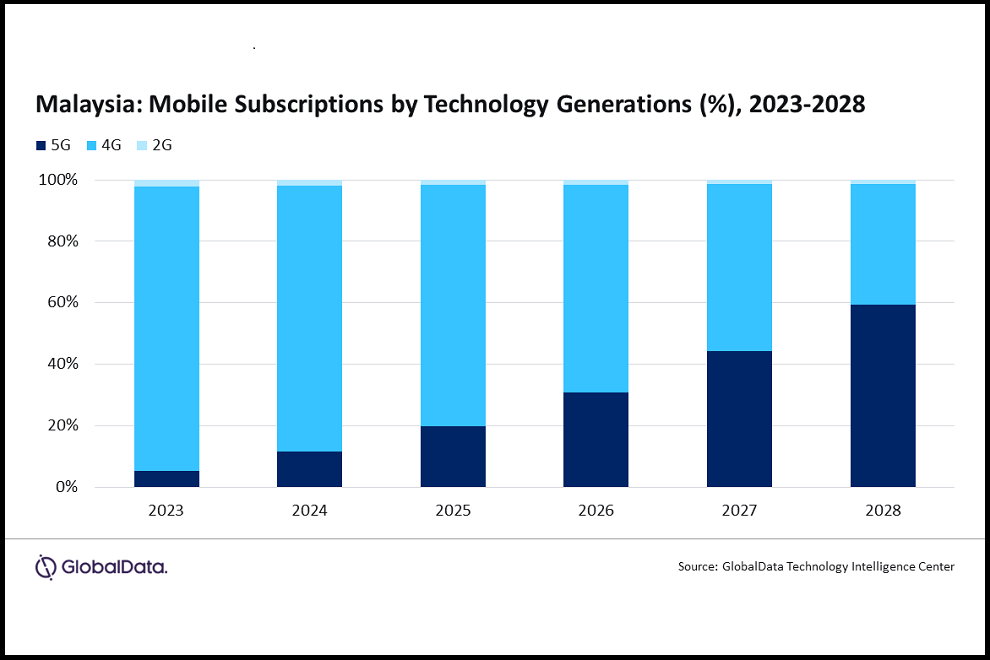

4G service accounted for 97% of the total mobile subscriptions in 2022 and despite the significant decrease in its share over the forecast period, it will remain the leading technology generation, by subscriber base, until 2027.

5G subscriptions, on the other hand, are expected to increase at a rapid pace over the forecast period and even surpass 4G in 2028 to account for a majority 60% share of the total mobile subscriptions. This growth will be driven by rising demand for high-speed wireless broadband services and growing availability of 5G services led by operators’ 5G network expansions and the government’s “Jalinan Digital Negara (JENDELA)” plan, also targeting 5G coverage expansion in the country.

Zeeshan concludes: “CelcomDigi leads the mobile services market in Malaysia in terms of mobile subscriptions, followed by Maxis. CelcomDigi will retain its leading position through to 2028, supported by its strong focus on 4G/5G network expansion and modernization to cater to the rising demand for high-speed services by residential and enterprise segments. CelcomDigi expanded its 4G network to 96.4% of the country’s population in 2022. It also announced a full-scale program to build a digital network, integrating and upgrading its networks with LTE-A and 5G technologies.”