XONA PARTNERS Report

In the wake of Mobile World Congress (MWC) 2025, we present this update amid a distinctly charged geopolitical climate. In the weeks leading up to the event, escalating tensions between the US and Europe over Ukraine, combined with looming tariffs and potential trade wars, dominated global headlines—setting a starkly different tone from previous years. Suddenly, a defense-tech focus emerged across the board, intersecting with telecom, satellite, and AI sectors.

This tense geopolitical environment reflects ongoing financial and economic austerity, as both operators and vendors tighten their belts to protect margins. A clear example is the operators’ firm rejection of the need for 6G, a message vendors have acknowledged.

Instead, vendors have focused their messaging this year on 5G Advanced features and the extensive integration of Artificial Intelligence (AI) across nearly every aspect of network performance and applications—from operations and business support systems to radio access, core, and transport networks—as well as across organizational functions like sales, marketing, customer support, and network operations.

Beyond the telecom and mobile realms, AI was omnipresent in the extensive array of applications demonstrated at MWC, ranging from health-tech and transportation-tech to smart cities and beyond. MWC appears to be transforming into something far broader than its original focus on mobile—becoming a hub for any technology with connectivity at its core. Essentially, everything!

As anticipated, AI was a dominant theme throughout the event. Although it was also a focal point last year, this year’s presentations indicate that progress remains limited in deploying revenue-generating services. The industry, particularly the enterprise sector, remains in observation mode—closely tracking rapid AI developments as they evolve from large language models (LLMs) to reasoning models and toward agentic AI frameworks. Early attempts are nderway to identify how to leverage these developments with solid RoI in mind (refer to our Xona Partners’ contribution to the ‘The AI Arms Race1’ on the FintechTalk Podcast for related developments).

One notable aspect of AI is the integration of DeepSeek into various offerings by Chinese and other Asian vendors, reaching a scale unmatched by any other engine and accomplished within a few months. Additionally, AI took center stage in showcases by leading operators, who presented AI-centric data center and GPU- as-a-service solutions for edge computing and distributed inference engines, with the goal of securing a share of the global AI data center and cloud markets.

Another evolving trend is the convergence of non-terrestrial networks (NTN) with mobile networks. This concept has moved from theory to practice with Starlink and T-Mobile launching their beta test service. Yet most operators are still in the early stages of defining their NTN strategies. Although some view NTN as a competitive threat, it also represents the potential for a complementary service that can attract customers in a tightly contested market.

An undercurrent throughout the event was the commoditization of infrastructure. There is growing anticipation that 2025 will see increased merger and acquisition activity, as consolidation and divestment strategies gain traction—even among regulators. The telecom industry, which once thrived on globalization by establishing global standards and harnessing economies of scale, now faces a future shaped by the emergence of antagonistic trading blocs. This shift could profoundly alter the operational and revenue models that have defined the industry for the past 35 years.

Key themes from last year’s MWC, including the development of the GSMA Open Gateway—a framework for common network APIs—are making steady progress. However, they remain in an evolutionary phase, awaiting industry validation and the commercial deployment of concrete use cases. Other themes that were previously in the early stages of development are now gaining greater emphasis. For instance, Quantum Security applications leveraging Quantum Key Distribution (QKD) encryption as well as post-quantum encryption algorithms are emerging as a strategic priority, positioning advanced cybersecurity at the forefront of vendors’ and a few leading operators’ agendas (notably SK Telecom, NTT and Telefonica).

Meanwhile, certain controversial trends, such as moving telecom network workloads to hyperscaler clouds like AWS, Azure and GCP, are facing a reality check. Most telcos continue to favor private cloud offerings for hosting their infrastructure, with RedHat demonstrating notable traction in this area.

The Geopolitical Context. While US-China relations continue to dominate the geopolitical landscape, escalating US-Europe tensions over Ukraine and the prospect of a global tariff war have further heightened uncertainty. This growing instability is expected to discourage cross-border transactions, intensify regulatory scrutiny on specific deals, and amplify the role of techplomacy (tech diplomacy) in navigating these challenges. In the immediate wake of these tensions, the stock prices of European defense contractors and satellite firms such as Eutelsat, Leonardo, Thales and others surged, reflecting investor confidence in increased defense spending and strategic shifts.

The ripple effects of this uncertainty—and the corresponding rise of techplomacy as a strategic tool— are evident across several key areas, including but not limited to the telecom equipment market, the subsea fiber cable sector, and the satellite industry.

• Telecom Equipment Market: This sector relies on a complex multinational value chain that has historically leveraged globalization to achieve economies of scale. However, tariffs and sanctions threaten to disrupt this structure, potentially harming all stakeholders. For instance, Acer has already announced a 10% price increase on laptops due to US tariffs on China. Similarly, the costs of fixed wireless access (FWA) customer premise equipment and other products are expected to rise, undermining the financial viability of numerous projects.

• Subsea Fiber Cable Sector: US-China rivalry, combined with concerns over regional security, has heavily impacted this market. Cables are being redesigned and rerouted to avoid sensitive regions, such as the South China Sea and strategic choke points in the Middle East. This has led governments, organizations, and regulators—including the ITU, EU, and FCC—to take proactive measures to address the critical issues of subsea cable resilience and security.

• Satellite Industry: Europe has recognized the need to establish its position between the mega constellations of the US (Starlink and Kuiper) and China (Qianfan— or Thousand Sails—and Guowang). In response, it has unveiled the €10.6 billion IRIS2 constellation, comprising 290 satellites across multiple orbits, to be developed through European partnerships involving Eutelsat, SES, and Hispasat. Meanwhile, OneWeb, with its fleet of 635 satellites and a $10,000 user terminal, is being evaluated as an alternative to Starlink—boasting approximately 7,000 satellites and significantly more affordable $500 user terminals—for supporting communications in Ukraine. The evolution of Eutelsat OneWeb’s assets and SES’s mPower capabilities within the framework of the IRIS2 constellation will be a key area to watch.

Financial Landscape. The capital expenditure freeze that began in 2023 largely persists, albeit with varying intensity across different regions. While we sensed a cautious optimism for a market recovery in 2025, the interplay of tariffs and geopolitics complicates the outlook.

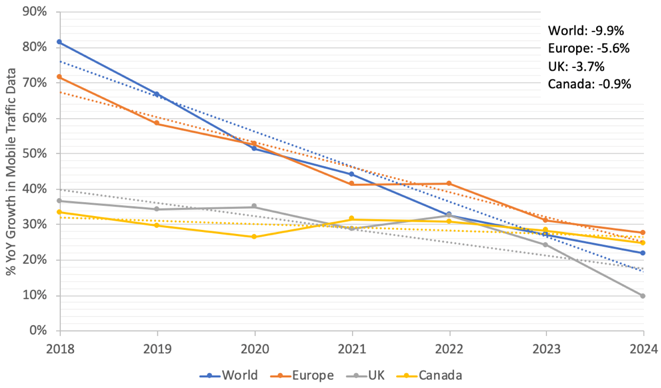

A significant challenge remains the inability of operators to effectively monetize 5G. The promise of generative AI driving an increase in uplink traffic has given vendors a reason to promote 5G Advanced. However, MNOs are grappling with slowing growth in mobile data traffic, which undermines the justification for additional capital expenditure.

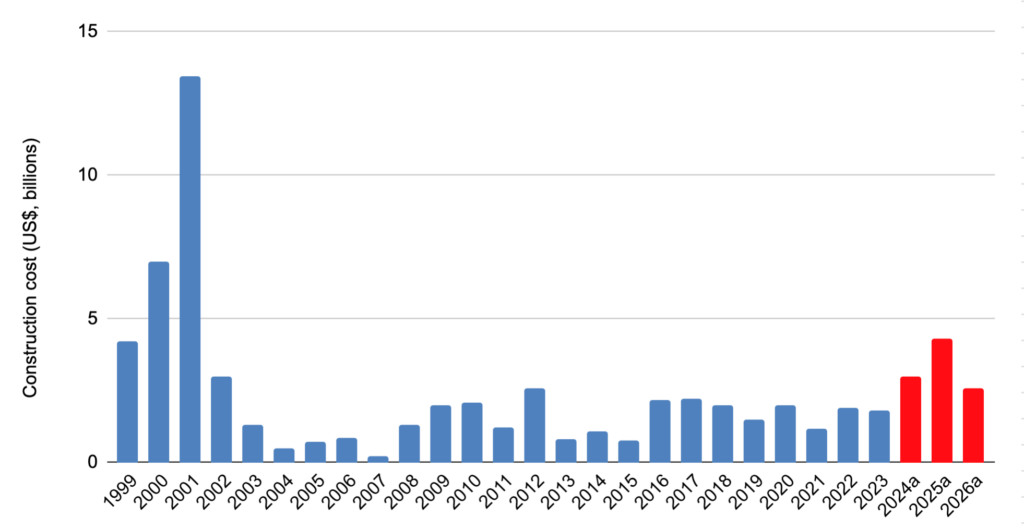

Conversely, the metro and long-haul fiber markets are experiencing a boom, fueled by growing demand for data center interconnectivity and AI digital infrastructure investments. This has benefited companies like Lumen and spurred investment in transoceanic subsea fiber to its highest levels in the years since the dotcom bubble.

On the other hand, government-backed fiber initiatives—such as the US BEADs program— face potential funding reallocations to include unlicensed and satellite wireless systems, potentially reducing the scope of fiber deployments.

Mergers, Acquisitions and Divestments. The telecom and data center M&A market saw an improvement in 2024, even as the aftereffects of a record-breaking 2021 continue to linger. Corporate M&As are primarily driving the market, while private equity firms continue to hold on to their investments. A further market boost is anticipated in 2025, though macroeconomic uncertainties—including tariffs and fluctuating interest rates—cast a shadow over the outlook.

Transactions in the service provider space highlights regional variations in business conditions. European operators, grappling with market fragmentation and margin compression, have turned to national-level consolidations, such as those in the UK and Spain, or asset divestitures, exemplified by Vodafone. Telefonica, facing the insolvency of its Peruvian operations, had similar goals of shedding its Latin American assets but fell short of investor expectations. This shortfall culminated in a change in the company’s leadership.

In contrast, M&A activity among US service providers remains focused on expanding market reach in wireless, fiber and data center assets. Transactions like T-Mobile’s acquisition of US Cellular underscore the importance of scale for competitive viability. US Cellular, as one of the last major regional operators, also highlights the growing appeal of transforming into a tower asset holding and management business.

We cite a few notable transactions to underscore strategic repositioning, asset optimization, and responses to evolving technological and market trends:

Mobile and fixed access service providers:

• Swisscom acquires Vodafone Italy for €8bn.

• Verizon bids $20.3bn for Frontier.

• Vodafone UK and Hutchinson’s Three $19bn merger is approved.

• Charter acquires Liberty Broadband for $16.6bn.

• Windstream and Uniti to merge at $13.4bn.

• Orange and Masmovil in Spain combine in a transaction valued at €6bn.

• T-Mobile and KKR acquire Metronet for $4.9bn.

• T-Mobile’s acquires US Cellular for $4.4bn.

• Telecom Argentina buys Telefonica Argentina for $1.2bn.

Satellite operators:

• SES acquires Intelsat for $3.1bn.

• Eutelsat sells 80% of its ground station infrastructure to EQT Private Equity Group netting €500m after tax.

• Ligado enters Chapter 11; secures $940m debtor-in-possession financing.

Infrastructure (Tower) Transactions:

• Verizon sells 6,000 towers to Vertical Bridge for $3.3bn.

• SBA Communications acquires 7,000 towers from Millicom for $975m.

• Cellnex sells tower assets in Austria (€803m), Ireland (€971m) and Poland (€3bn) to pay down its debt.

• DigitalBridge buys-out Japanese infrastructure provider JTower for $466m.

• EQT and Zayo acquire Crown Castle’s fiber and small cell assets for $8.5bn.

Vendor Transactions:

• HPE $14bn acquisition of Juniper is blocked by the US Department of Justice.

• Amphenol acquires Commscope’s Mobile Networks Businesses for $2.1bn.

• Nokia acquires Infinera in a $2.3bn deal, and sells ASN to the French state for €350m.

Technology Themes.

Disruption in the Satellite Sector. The competitive pressure from Starlink is significantly impacting the financial performance of GEO satellite operators. Eutelsat reported a $560 million impairment loss on its GEO assets, while Moody’s downgraded SES’s credit rating. Many of Starlink’s 5 million subscribers have switched from providers like Hughes and Viasat, with the latter losing 50% of its US fixed access subscribers since Starlink’s launch. Notably, much of Starlink’s success has been concentrated in developed markets, where its relatively affordable user terminals are accessible. However, in the developing world, high user terminal costs and regulatory hurdles, present a significant barrier to entry, reinforcing the perception that connectivity remains a zero-sum game—where one provider’s growth often comes at another’s expense.

The disruption is set to deepen as Starlink seeks growth by targeting additional markets. Launched in late 2020 as a consumer fixed-access service, Starlink has progressively expanded its offerings to include enterprise, aviation, maritime, government, defense, rural gateways, and direct-to-device markets. This evolution was a necessary step toward profitability, driven by the imbalance between the localized nature of capacity demand and the globally distributed capacity supply of LEO constellations. These constellations, characterized by inherently low utilization rates, must diversify their market base to achieve long-term financial sustainability.

Looking ahead, further consolidation is expected in the GEO satellite sector, following earlier deals such as Viasat’s $7.3 billion acquisition of Inmarsat in 2023 and SES’s announced $3.1 billion acquisition of Intelsat in 2024. Additionally, government involvement in the sector is poised to strengthen, driven by geopolitical considerations. LEO constellations have become symbols of sovereignty and power projection. Examples include support from the Canadian government, as well as the Quebec and Ontario governments, for Telesat’s Lightspeed constellation; the EU’s proposed €10.6 billion IRIS2 constellation; and China’s mega-constellations Qianfan and Guowang—underscoring the growing role of governments in space infrastructure investments.

Space is rapidly emerging as the next frontier for competition among service providers and vendors, extending well beyond the traditional satellite sector. One prominent example was Nokia’s bold attempt to achieve the first moon-to-Earth cellular call. However, this effort failed when Intuitive Machines’ Athena moon lander, carrying Nokia’s 4G/LTE base station, landed in the Moon’s south polar region on March 6th with an incorrect orientation (attitude). A similar fate befell the first lunar-based data center, designed and operated by Lonestar Data Holding, which was also transported to the Moon on the same mission. These early ventures highlight the challenges of merging space and telecommunications technologies. Nonetheless, they mark the beginning of what promises to be a series of ground- breaking attempts in the coming years.

Satellite-Mobile Convergence. Starlink and T- Mobile have launched their direct-to-device (D2D) public beta service, marking a significant step in satellite-mobile integration. This service stands apart from the earlier Apple-Globalstar offering by utilizing T-Mobile’s terrestrial spectrum under the FCC’s recent Supplementary Coverage from Satellite (SCS) framework, as opposed to Globalstar’s MSS spectrum. While the service offers emergency connectivity, T- Mobile’s broader objectives include reducing churn, upselling subscribers to higher-priced plans, and drawing customers away from major competitors such as Verizon and AT&T. The use of Starlink’s Non-Terrestrial Networks (NTN) as a differentiated service in a zero-sum market introduces new competitive dynamics among operators but is only viable in regions with extensive geographic footprint.

For markets with smaller footprints, constellations offering more targeted satellite coverage are crucial. AST SpaceMobile, which provides such capabilities and boasts higher data rates than Starlink, has been actively expanding its list of MNO partners. The company has raised approximately $2 billion as it prepares to launch 45 to 60 satellites to kickstart its service. However, AST, which requires an estimated additional $3 billion, along with competing constellations such as Lynk Global—despite its recent partnership and funding from SES—and Iridium, are all expected to continue facing significant funding challenges. These persistent difficulties reflect broader constraints within the current investment landscape.

While financing challenges remain, the regulatory landscape has become increasingly favorable to D2D services. The FCC’s publication of its Supplementary Coverage from Space (SCS) framework has set a precedent, with Canada following suit by designating select terrestrial mobile bands for secondary priority use as MSS spectrum. Regulators are also placing greater emphasis on network resiliency and emergency roaming, driven by growing concerns over the increasing frequency and severity of network outages as systems become more complex. Notably, IRIS2 stands for “Infrastructure for Resilience, Interconnectivity and Security by Satellite.”

Private Wireless Networks (PWN). 5G promised operators and vendors new revenue streams by enabling enterprise digital transformation PWNs. These networks capitalized on reduced telecom infrastructure costs, driven by advancements in silicon, network function virtualization (NFV), and open, interoperable interfaces. However, despite many regulators opening spectrum bands to support PWN deployments—pioneered by Germany in 2019 and most recently by Canada with its NCL framework—PWNs have been slow to gain commercial traction. The lack of spectrum harmonization has created a fragmented, high-SKU, low-volume market, inflating costs and limiting adoption to only the enterprises capable of affording them.

Compared to previous years, there has been an increase in PWN deployments, along with related solutions such as neutral hosts and shared-spectrum solutions, in select geographies. However, on a global scale, PWN deployments continue to fall short of analyst expectations in most markets outside of China, where government directives and financial incentives have driven substantial rollouts.

By the end of 2024, Nokia reported having 820 PWN customers, representing a compound annual growth rate (CAGR) of 45% since 2019. Similarly, Germany’s regulator, BNetzA, issued 474 PWN spectrum licenses between its initial rollout in late 2019 and 2024, reflecting a CAGR of 49% since 2021. Looking ahead, there is a growing sense of optimism about the future of PWN deployments.

Current PWN market dynamics indicate that innovation in this space is more likely to emerge from China and smaller vendors operating outside of China. Major telecom equipment vendors like Ericsson and Nokia have little incentive to develop dedicated PWN-optimized solutions, particularly for the radio access segment. Instead, they continue to repurpose their carrier-grade products for this market while leveraging partnerships with innovative small private companies.

Radio Access Network (RAN) Evolution. There is a growing consensus that Open RAN, defined as a multivendor RAN based on standardized and interoperable interfaces, is “dead” for commercial applications, though it remains an infrastructure-critical platform for government and defense use cases. Reports of Open RAN’s demise gained traction in 2024, with Mobile Experts indicating an 83% decline in the Open RAN market for the year. Major operators such as AT&T and Vodafone have opted to single baseband vendors while allocating limited volumes to secondary O-RAN compliant radio vendors.

New entrants like Rakuten Symphony and Mavenir have struggled to gain traction, effectively missing the 5G deployment cycle. Even established vendors like Nokia are facing significant challenges. Rumors of Nokia’s potential sale to Samsung circulated in the past, but more recently, speculation has emerged regarding the sale of its mobile unit to a U.S. entity. Although further deployments remain, the opportunity window has largely closed.

The decline in the RAN market began in 2023 and continued into 2024, with the Dell’Oro Group reporting a 30% year-over-year decline for the first three quarters of 2024, building on a $4 billion contraction in 2023. We stand by our earlier assessment that Open RAN was fundamentally at odds with a market structure that favors vertical integration for financial optimization. Fragmenting the supply chain across multiple vendors would lead to margin stacking and inefficiencies, ultimately driving the market back toward a vertically integrated model.

In contrast to the declining enthusiasm for Open RAN, Nvidia’s AI RAN, first unveiled at last year’s MWC, is emerging as a counterweight. The AI RAN Alliance has grown to 75 members, though it still lags behind the O-RAN Alliance in MNO participation. Nvidia positions GPUs as the preferred processors for baseband functions, drawing parallels to Intel’s earlier promotion of Cloud or Virtual RAN, where CPUs managed these tasks. However, Nvidia faces a tougher challenge than Intel, primarily due to the higher costs of GPUs compared to CPUs. To justify this premium, Nvidia, in partnership with SoftBank, claims operators could achieve $5 in inference revenue for every $1 invested in GPUs—a proposition that remains to be validated by the market.

Running telecom baseband workloads in data centers is not a novel concept and is relatively well understood. The main barriers to adoption remain the costs and availability of fiber optic fronthaul transport and the performance advantages of centralized processing. GPUs outperform CPUs in handling low-level physical layer functions, which often require offloading to accelerated processing units when CPUs are used for baseband operations. Consequently, various functional splits have been developed to optimize silicon placement for baseband processing, balancing the costs associated with transporting data between these components.

AI RAN necessitates the alignment of RAN and AI architectures to effectively balance cost and performance. AI systems typically depend on high computational power in centralized data centers for training, while requiring less intensive distributed edge computing resources for inference. In contrast, RAN architecture demands high- power computing at the edge to manage compute-intensive and time-sensitive physical layer functions, with central processing dedicated to less demanding upper-layer tasks.

Ultimately, the success of AI RAN depends on demonstrating that the AI applications they enable can justify the required investment. A compelling example presented at MWC was a solution from the startup Tiami Networks, which leveraged RAN infrastructure to detect and track flying drones and other objects. Similarly, Huawei showcased several applications utilizing RAN-centric measurements for advanced sensing and imaging purposes.

5G Advanced and 6G. The 3GPP held its first workshop on March 10–11, 2025, in Incheon, South Korea, to initiate the standardization process for 6G. While a few exhibitors at MWC boldly claimed 6G capabilities, the official standard is not expected to be finalized until sometime in 2029. Two main points of consensus about 6G have emerged so far: (1) operators show no interest in deploying a fast-tracked 6G technology, and (2) the industry does not want multiple options for core network implementations, citing the slow adoption of standalone (SA) 5G cores. In other words, operators are not looking for a 6G plan that replicates the approach taken with 5G. Instead, they want to prioritize pragmatic needs, such as indoor applications, Wi-Fi integration, and NTN use cases.

The lack of enthusiasm for 6G is mirrored in the slow adoption of 5G Advanced RAN features and SA 5G core networks, which are being deployed at a rate of roughly a dozen per year. As of now, 65 operators have implemented some form of 5G SA, a modest figure compared to the GSMA’s count of over 750 MNOs. T-Mobile’s recent launch of 5G Advanced serves as a blueprint for what future launches would look like: the technology roadmap is laden with numerous functions, services, and options, making the nomenclature irrelevant for describing the technology. Consequently, it would not be surprising for some service providers to claim 6G capability even before the standard is officially finalized!

Under pressure to grow their top lines, vendors have found a potential ally in generative AI applications. The premise is that mobile subscribers will dramatically increase their uploads of graphics and videos, necessitating the deployment of 5G Advanced features to handle the anticipated data surge. However, this outcome remains doubtful.