An opportunity for mobile network operators

Dr. Karim Taga

mHealth has been hailed as the next major development for mobile networks operators (MNOs), but could it be just wishful thinking from a sector desperately seeking additional revenues to offset margin erosion? While few commercial offers currently exist, mHealth is firmly on the agenda for many MNOs. In this viewpoint, Arthur D. Little assesses the key success factors that lay the foundations for operators to successfully navigate the mHealth minefield.

With the right approach, mHealth can outperform even the highest of expectations.

Advances in mobile technology have the potential to transform the way health care is delivered. mHealth, or mobile health, is the application of mobile technologies in health care systems that enables the transformation from physician-centric to patient-centric health care delivery. mHealth enables critical decision support to be lever-aged at the point-of-care, ensuring the accuracy of clinical information and leading to higher quality patient outcomes while reducing medical errors, which are estimated to cost the U.S. $19.5 billion annually.

For example, with an additional mHealth subscription through his mobile operator, a patient with hypertension could be provided with a blood pressure monitor that is wirelessly connected to his mobile phone and sends real-time updates to his doctor over the mobile network.

Current health care delivery systems are becoming increasingly un-sustainable in both developed and emerging markets. In developed markets, an aging population and the evolving nature of medical conditions have shifted the focus to the long-term management of chronic conditions for a greater number of patients. As a result, spending on health care is increasing to unsustainable levels. In contrast, emerging markets are facing a significant shortage of trained medical staff, which has resulted in insufficient access to basic medical care. The rapid adoption of mobile technology can provide a fresh impetus for the health care industry to address such problems through the remote delivery of health care services, such as health education and awareness, remote data collection, remote monito-ring and epidemic tracking. mHealth also promises a significant boost in MNO revenues, resulting in a classic “Win-Win” situation.

Given the prospects for mHealth, it is not surprising that analysts are estimating mHealth’s potential value to be up to 10 billion dollars within the next five years. However, while expanding into mHealth can create value and new growth opportunities for MNOs, there are significant challenges. Operators have been cautious about developing mHealth solutions due to the nascent state of the mHealth ecosystem and its unproven business models. In this viewpoint, Arthur D. Little assesses the key success factors for operators to successfully navigate the mHealth minefield. These include identifying the most suitable mHealth solutions, the most appropriate business model, and the key responsibilities for mobile operators.

Given the prospects for mHealth, it is not surprising that analysts are estimating mHealth’s potential value to be up to 10 billion dollars within the next five years. However, while expanding into mHealth can create value and new growth opportunities for MNOs, there are significant challenges. Operators have been cautious about developing mHealth solutions due to the nascent state of the mHealth ecosystem and its unproven business models. In this viewpoint, Arthur D. Little assesses the key success factors for operators to successfully navigate the mHealth minefield. These include identifying the most suitable mHealth solutions, the most appropriate business model, and the key responsibilities for mobile operators.

There is no one-size-fits-all mHealth solution for all markets

The demand for, and the nature of, mHealth solutions depend on the degree of development and specific characteristics of individual markets. Emerging markets are characterized by a low degree of development of the health care infrastructure and regulatory environment, low ability to pay, and rapid growth in mobile penetration. Maximum value from mHealth in these markets intuitively comes from keeping offers simple. In such environments, mHealth can be an enabler for the provision of fundamental health care access to the masses.

Conversely, developed markets are typically characterized by an established health care infrastructure, an aging population and high levels of smartphone penetration. However, developed markets are also likely to have a highly regulated health care environment that imposes controls on the provision of health care, the players who can participate and the accessibility of medical records. In this environment, mHealth should be treated as a complementary and sophisticated enhancement to traditional health care services, which leverages existing technologies.

Utilize internal capabilities and leverage partnerships to create maximum value

As existing ecosystems are still nascent, mHealth business models are largely unproven and there is no clear benchmark model to adopt. However, it is clear, that partnerships will be necessary as no single player will have all the essential capabilities required to deliver such solutions. Hence, the resulting business model and selection of partners will depend on the MNO’s technological, as well as its commercial, regulatory and organizational capabilities.

Fundamental technological capabilities necessary to launch mHealth services include a scalable network architecture to support M2M business, an agile service layer architecture, an enterprise-based OSS/BSS architecture and security systems. Key commercial capabilities include the experience of a reliable health care service provider, strong consumer brand, large customer base and broad retail distribution channels. An assessment of these factors has lead to five potential business models (see Figure 1).

The mHealth opportunity for an MNO is significant, but the value created will have to be shared among the partners delivering the mHealth service. Our expert analysis shows that operators which play only the connectivity role can access up to 20 percent of the mHealth market value, but there is potential to retain approximately 45 percent of the market value when delivering end-to-end solutions. Hence, in order to limit the value that it must share with partners, the MNO should focus on maximizing its contribution by making the most of its internal capabilities.

Keep it simple for emerging markets mHealth solutions bring basic health care to the masses

In emerging markets, mHealth solutions, such as the delivery of medical information by SMS or MMS, medicine reminders, remote data collection, and medical help-lines, can help improve patients’ access to basic medical care.

The delivery of health information by SMS can be used to raise awareness and to educate the population. The mHealth Company (MHC), based in Saudi Arabia, is working with several MNOs in the region to provide comprehensive health education by SMS and MMS. One such partner is Saudi Telecom Company, which recorded a peak of 430,000 monthly subscriptions with a 70 percent retention rate. Overall, MHC has achieved a total subscriber base of 2 million since its launch in 2009.

Another relatively basic mHealth service is a help-line that connects mobile phone callers to a health care call center staffed by trained specialists. While this service keeps the technology requirements low for the patient, it requires more health care resources to be located at the call center.

Additionally, health care providers can use mHealth services to provide remote diagnosis support to field staff and also to suggest treatments. Health care experts located in a central facility can use the service to remotely support in-field health care workers with PDAs or a laptop computer equipped with a mobile broadband or video conferencing.

In emerging markets, MNOs must drive mHealth, often in cooperation with NGOs

In emerging markets and especially in rural communities, MNOs are most likely to take on a “lead partner” business model to offer basic services. As investment costs are likely to be higher and ARPU

In emerging markets and especially in rural communities, MNOs are most likely to take on a “lead partner” business model to offer basic services. As investment costs are likely to be higher and ARPU

lower, the focus must be on capturing a large subscriber base. The role of NGOs and government agencies will be critical in capturing a broad subscriber base as they have the expertise and reach essen-tial to penetrate this market and raise awareness of the service.

Roshan, Afghanistan’s largest MNO, has adopted this approach by partnering with the Aga Khan Fund for Economic Development. With its NGO partner, it has been running a telemedicine program with mHealth initiatives, such as equipping remote health centers with basic medical kits and connected smartphones, training of midwives via SMS and running a small fleet of mobile-equipped, multi-functional bikes with screens to display health information videos.

In developed markets, operators must focus on solutions that fit within the current health care industry structure.

Smartphones and Apps drive mHealth

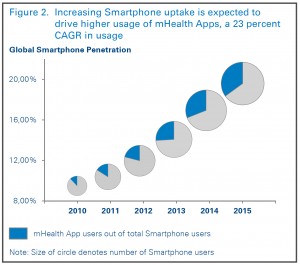

In developed countries, the rapid adoption of smartphones and tablet devices, such as the iPad, by health care providers has triggered a significant growth in the use of mHealth Apps. It is estimated that the market for such Apps will reach $1.7 billion by the end of 2014. Furthermore, over 500 million people, about one-third of smartphone users, are expected to use health care mobile applications on their smartphones by 2015 (see Figure 2).

mHealth could provide a mobile operator with the opportunity to not only increase ARPU, but also acquire new subscribers and control churn. There are over 17,000 mHealth applications currently in major App stores, of which 74 percent are based on a paid business model.

The greatest health care issue facing developed countries today is the high cost of treating chronic diseases. According to the Center for Disease Control and Prevention, the cost of treating chronic disease in the United States constitutes 83 percent of total Medicaid and 96 percent of the total Medicare expenditure. In Denmark, chronic diseases account for 70-80 percent of its health care expenditure. In the United Arab Emirates, 20 percent of the adult population has diabetes, which consumes 40 percent of the country’s health care expenditure.

Given the high and increasing smartphone penetration in developed markets, health industry players are entering the mHealth market as a way to drastically reduce costs while focusing on prevention and management, rather than cure. Within the next 5 years, mHealth is expected to target 220 million diabetes patients and around 400 million obesity cases globally, resulting in savings of US$ 20 billion per year for health care providers, according to West Wireless Health Institute.

Remote monitoring and wellness enhancement are key revenue drivers

One of the latest market offerings tailored to manage chronic diseases is a remote monitoring service. The service consists of a medical device that can monitor vital signs associated with diabetes or hypertension, a mobile device for transmission, a centralized platform for diagnosis and analysis, health care providers for interpreting the analysis and additional support and a communications gateway for informing the patient of any specific actions that must be taken. This patient-centric service, typically offered at a premium, enables patients to take control of their own medical conditions.

The first patient-centric and commercially available remote monitoring service, “healthe”, was launched by Orange Austria in June 2010. Users pay the equivalent of $14 per month for access to the monitoring service and access to up to 5 caregivers, and an additional $2.8 per month for the notification package.

Other revenue-enhancing services are focused on fitness and wellness enhancement. NTT DoCoMo, a Japanese MNO, launched “i Bodymo”, which monitors physical activity and food intake and provides diet and health tips for a monthly fee of $1.75. Since its launch in May 2010, the service has attracted 1 million subscribers.

In addition to complex solutions, basic mHealth services are still very attractive for MNOs in developed markets, due in part to their ease of implementation and their ability to reduce operating costs for the health care provider. In February 2011, Mobily, a Saudi Arabian MNO, partnered with the Al Habib Medical Group to deliver the “Mobile Baby” App, which simply enables ultrasound images and video to be sent to subscribers’ mobile phones.

Leverage the existing health care ecosystem

As market conditions in developed countries create high entry barriers for operators wishing to develop their own offerings, MNOs should leverage the existing ecosystem. When launching mHealth services, a key success factor will be the mobile operator’s ability to develop well-integrated partnerships to ensure interoperability and jointly navigate regulatory issues.

For example, in order to provide the “healthe” service, Orange Austria relies upon a consortium of highly integrated partners. Alcatel-Lucent brings technical expertise to the medical platform, as well as the mobile applications; the device manufacturers, Nokia and Lifescan, have enabled their respective mobile handsets and medical devices for “healthe”. ArbeiterSamariterbund provides the medical expertise and runs the dedicated hotline. Last, but not least, Orange provides the marketing and distribution of the service, as well as the encrypted connectivity and billing. All devices and peripherals are sold through its network of 94 Orange shops across Austria.

Device manufacturers play an active role by providing handsets, smartphones, and integrated medical devices that can function with existing mobile operating systems. A medical device manufacturer in Singapore, EPI Health Pte, has been advancing interoperability with the EPI Mini, a medical Bluetooth device that works with all major smartphones, transforming them into EKG devices.

Guidelines to avoid pitfalls and maximize opportunities

Clearly, mHealth is unlike any other mobile service and requires a completely new market entry strategy. The MNO must assess its own capabilities, decide what role it will play and how it will contribute to the service, align the internal capabilities required for the selected business model, and then partner with other players to acquire key capabilities to effectively and efficiently bring patients into the ecosystem.

However, by sticking to a few simple guidelines, MNOs can avoid major obstacles and increase their chances of success:

Mobile operators in emerging markets should:

• Focus on simple offersnn – SMS-based solutions are very attractive

• Take the lead role in developing the ecosystemnn – no one else will do it for you

• Cooperate with NGOs and government agenciesnn – they have local expertise and contacts

However, they should not:

• Pursue complex offeringsnn – smartphone penetration and ability to pay are low

• Expect to leverage an existing ecosystemnn – there is none

• Do it alone nn– NGOs and government agencies want to help

Mobile operators in developed markets should:

• Leverage the high smartphone penetration to offer sophis-nnticated services – remote monitoring is a key ARPU driver

• Leverage an existing ecosystemnn – do not reinvent the wheel

• Develop tightly integrated partnershipsnn – to obtain key capabilities and ensure interoperability

• Contribute as much as possible to the partnershipnn – to maximize retained value

They should not:

• Focus on overly complex offerings that require structural nnchanges to the industry

• Develop a new ecosystemnn – the barriers to entry are high

• Forget to consider basic servicesnn – they are simple to implement, effective and low cost

If these guidelines are taken into account, then we believe mHealth will surpass even the most optimistic industry predictions within the next five years and add significant value to the mobile industry.