Hilal Halaoui

Chady Smayra

Lancelot Sursock

Even though the worst of the global economic slowdown has passed, telecom operators worldwide face a raft of challenges that could impede their path to pre-recessionary growth levels. With sky-high penetration levels in traditional businesses, operators no longer can assume steady revenue gains. Competition is heating up—not only from other telecom operators but also from new entrants, including Apple, Google, Skype, and Facebook. Meanwhile, consumers are becoming more demanding and sophisticated, expecting operators to provide an “all you can consume” Internet model via ubiquitous bandwidth and the latest services at low flat rates.

These trends are starting to emerge in the Gulf Cooperation Council (GCC)1 region, with revenue growth in the telecom sector slowing, competition rising, and consumers increasingly demanding more services and better performance at reduced prices.

The global operators hit hardest by these trends have undertaken substantive measures to adapt structurally to face these challenges. GCC operators also are starting to respond to the trends now emerging in the region through tactical, short-term cost reductions. These moves will prove to be insufficient to mitigate the full impact of the trends affecting the sector.

The global operators hit hardest by these trends have undertaken substantive measures to adapt structurally to face these challenges. GCC operators also are starting to respond to the trends now emerging in the region through tactical, short-term cost reductions. These moves will prove to be insufficient to mitigate the full impact of the trends affecting the sector.

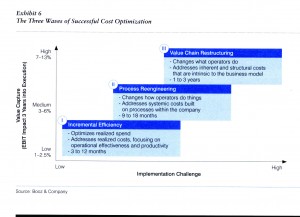

By rigorously identifying and applying relevant cost measures, telecom operators can position themselves to weather the ongoing industry challenges and extract benefits from leaner operations. There are three waves of cost optimization that operators need to consider: incremental efficiency, process reengineering, and value chain restructuring. Deploying the right mix of these initiatives will enable operators to create—or sustain—value, out-perform their competitors, and secure their sustainability in chosen markets.

Telecom operators face mounting pressures

Telecom operators worldwide are emerging from the global recession. At the same time, they are facing increasing pressures on both their top and bottom lines. In Europe, for example, revenues of major incumbent operators have declined at a rate of 1.2 percent annually over the past five years. Although revenue growth is still positive in the GCC region, it has begun to slow recently. Average returns on assets have dropped by nearly half over the past five years to approximately 8 percent per year, and appear headed toward 5 percent, the level commonly seen in saturated markets.

Three key trends are converging to pressure the profitability of the telecommunications market worldwide: stagnating growth, increasing competition and market fragmentation, and growing customer sophistication and demand for services. Some markets, such as Europe and the U.S., are prone to all of these pressures.

Three key trends are converging to pressure the profitability of the telecommunications market worldwide: stagnating growth, increasing competition and market fragmentation, and growing customer sophistication and demand for services. Some markets, such as Europe and the U.S., are prone to all of these pressures.

The GCC region recently has seen increases in competition and market fragmentation, as well as a slowdown in growth. Based on the experiences in the other more mature markets, it, too, will soon face added pressure from consumers. In response, operators will need to prepare for constrained growth and compensate by creating leaner organizations.

Stagnating Growth

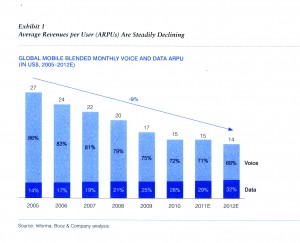

The global telecommunications market has been stagnating as many markets approach their saturation point, a trend underscored by high penetration rates. In these markets, operators are experiencing slowing or decreasing average revenues per user (ARPU) and face the need to prepare for limited growth from traditional services (see Exhibit 1).

The global telecommunications market has been stagnating as many markets approach their saturation point, a trend underscored by high penetration rates. In these markets, operators are experiencing slowing or decreasing average revenues per user (ARPU) and face the need to prepare for limited growth from traditional services (see Exhibit 1).

The GCC has the highest mobile penetration rate in the world, followed by Europe. Much of the reason for the high penetration rates in the region is the abundance of customers who use more than one SIM card; the multi-SIM factor exerts considerable pressure on revenues per user, while pushing up costs. Still, regional telecom operators overall continue to post revenue gains. However, the high penetration rates show that the region is likely approaching saturation levels, and revenue growth is slowing. In fiscal year 2010, incumbent operators in Saudi Arabia, the UAE, Qatar, and Bahrain began to experience flat or decreasing revenue growth. As a result, operators will need to rely on efficiency gains rather than scale alone to maintain their bottom lines.

Increasing Competition and Fragmentation

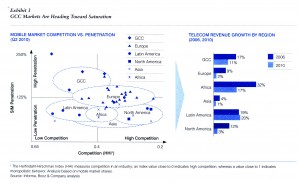

Globally, the increase in the number of operators has steadily outpaced that of market revenues. The number of telecom operators has increased by 70 percent since 2005, whereas industry revenues increased by only 45 percent over the same period. Facility-based operators have grown by 6 percent per year, while mobile virtual network operators (MVNOs) and Internet service providers have grown at over 15 percent a year (see Exhibit 2).

In addition, the emergence of nontraditional competition from the likes of Google, Facebook, and Skype has put additional pressure on industry pricing. Some nontraditional counterparts now offer free voice or messaging services such as VoIP, video chat, and instant messaging to selected destinations. Some even offer ubiquitous online phone numbers that could be used through multiple devices.

The increasingly competitive GCC telecom market appears to be approaching the high fragmentation levels of some European and North American countries. Saudi Arabia has emerged as the most fragmented market in the region (see Exhibit 3). Fragmentation in regional telecom markets will likely increase as VNOs and branded resellers proliferate across GCC markets. For example, in Oman, Friendi has been able to grab a 4 percent share of the country’s subscriber base in its first year.

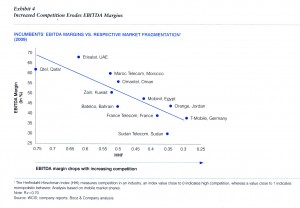

Increased fragmentation will likely continue to strain profitability. Results from other highly fragmented markets suggest that incumbent operators’ profitability will come under increasing pressure—a one-to-one linear relationship between the Herfindahl-Hirschman Index (HHI), which measures competition within an industry, and the incumbent operators’ earnings before interest, taxes, depreciation, and amortization (EBITDA; see Exhibit 4).

Sophistication of Customer Tastes and Expectations Changing consumer trends is another area in which GCC operators can see the shape of what’s to come.

Sophistication of Customer Tastes and Expectations Changing consumer trends is another area in which GCC operators can see the shape of what’s to come.

In mature markets, the increasing sophistication of customers coupled with new competition from non- telecom players is ratcheting up costs, as operators spend more to attract, acquire, serve, and retain customers. Depending on market maturity, telecom operators presently allocate between 5 and 10 percent of their operating expenses to attract customers; the more mature the market, the more it costs to acquire a new customer. For some incumbents, subscriber acquisition costs have almost doubled over the past five years, reaching six times monthly ARPU on average in Europe compared to around one times the monthly ARPU in emerging markets. In addition, operators are more likely to offer flat rate and converged packages to customers in mature markets—further crimping profits. As for retention, European operators redistribute up to 3 percent of revenues on retention efforts such as loyalty programs. The implications are significant for GCC operators that will face upward pressure on marketing expenditures as their markets reach maturity. These regional incumbents will have to increase their marketing expenditures and, in turn, try to reduce many other cost items both in absolute and relative terms.

In mature markets, operators must also meet a marked rise in consumer demand for ubiquitous access and bandwidth-hungry services, which increases capital expenditure requirements—particularly on the fixed network side, with costs relating to deploying fiber. In the U.S., data traffic is nearly doubling every year, and similar increases in the GCC are likely to come. Booz & Company estimates that the number of fixed broadband users will double in the MENA region within four years, while the number of mobile broadband users will increase an estimated 10-fold over the same period and exceed 100 million users by 2014. Those rapid subscriber gains indicate that regional operators will likely face the same pressure to build up their infrastructure that operators in the U.S. and Europe experienced. Customer demand for ubiquitous broadband data access is prompting operators and governments to join forces to deploy national broadband networks—a costly project that could account for as much as 10 times the EBITDA of an operator’s national business.

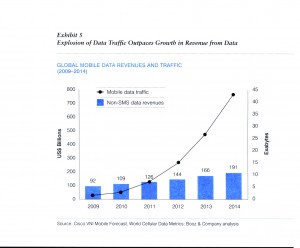

A troubling trend from an operator’s vantage point is that revenue is not increasing commensurately with data usage (see Exhibit 5). The limited revenue increase for data usage indicates that customers do not pay more as they use more bandwidth.

What’s more, the decrease in bandwidth cost that will result from the advent of LTE and fiber will only partially compensate for the increase in usage. In some markets, the disconnect between usage and revenue is pressuring operators to abandon offering unlimited data packages.

What’s more, the decrease in bandwidth cost that will result from the advent of LTE and fiber will only partially compensate for the increase in usage. In some markets, the disconnect between usage and revenue is pressuring operators to abandon offering unlimited data packages.

For example, AT&T, O2 UK, and Vodafone all have announced shifts away from unlimited data service offerings toward tiered pricing, in which customers pay more for greater data usage. T-Mobile UK recently introduced a more stringent usage policy for mobile data consumption. GCC operators largely have not had to abandon unlimited data packages yet, but might soon have to consider alternative plans as usage increases.

Cost optimization: Riding three waves to savings

Regional telecom operators can formulate a response to these challenges by looking to global operators that have taken several steps to rein in costs. European incumbent operators have succeeded in bringing down operating expenditure as a percentage of revenue by about 2 percent per year over the past decade by engaging in a number of cost optimization iterations.5 For example, over the past decade incumbent operators have shed at least 15 percent and as much as 45 percent of their total head count, enabling productivity enhancements of approximately 50 percent.

In addition, operators have reduced capital expenditures: Ratios of CapEx to revenue have decreased by one percentage point per year over the past five years. Cuts in capital spending on mobile operations have been more dramatic; operators have slashed CapEx as a percentage of revenue by as much as 20 percent in markets such as France and the U.K. An increase in fixed line capital expenditures has partially offset the drop in total spending, driven by fiber and IPTV deployment in markets such as France and Portugal. Overall, operators have kept capital spending in check through smarter procurement, scale efficiencies, group synergies, 6 and focused deployment of fixed and mobile investments.

This would be an ideal time for GCC operators to garner such savings, as they will likely have to increase their spending on customer-facing areas, such as new subscriber acquisition and retention incentives.

Fortunately, GCC operators have a lot of room for improvement in cost optimization. Because revenue growth has remained stronger in the GCC than in other markets, regional operators have not focused on curbing expenditures nearly as much as counterparts in Europe and the U.S. Their efforts have mainly centered on trimming budgets and making limited head- count reductions. Most initiatives have been tactical and short term.

Regional telecom operators can benefit by grouping cost optimization initiatives into three waves. The first, incremental efficiency, involves making informed decisions to reduce costs by shedding excessive expenditures through better budget allocation and use of resources in ongoing activities. This usually yields rapid cost reduction and helps maintain a healthy cost structure. The second wave, process reengineering, is about changing the ways in which operators do their work and maximizing cross functional efficiencies. Compared to Wave 1, in which operators optimize spending in light of ongoing activities, Wave 2 challenges the way operators run their business and exposes new cost inefficiencies that they can further optimize. The final wave is value chain restructuring, which encompasses sweeping initiatives that redefine operators’ business models to determine and reinforce their key capabilities and identify for divestment those activities that do not truly reflect the business’s strengths or long-term goals (see Exhibit 6).

These three waves are run concurrently and iteratively, to strike the needed balance among the choice of activities along the value chain, the processes in place, and the operational efficiency and capital expenditure allocation. The application of the three waves is a virtuous circle that allows operators to innovate continuously and expand their offerings while avoiding a buildup of layers of inefficient spending.

These three waves are run concurrently and iteratively, to strike the needed balance among the choice of activities along the value chain, the processes in place, and the operational efficiency and capital expenditure allocation. The application of the three waves is a virtuous circle that allows operators to innovate continuously and expand their offerings while avoiding a buildup of layers of inefficient spending.

In developed markets, operators have already embarked on cost optimization initiatives in all three waves, trying to extract as much value as possible in terms of new revenues and lower costs, and thus improving the bottom line. GCC operators, however, are at earlier stages of this process, as they have yet to face the brunt of the challenges facing the industry worldwide. As a result, they have only scratched the surface in terms of capturing incremental efficiencies and have not ventured materially further. This means efforts to improve cost optimization can generate significant potential upside.

Wave 1: incremental efficiency

This wave of cost optimization takes a holistic view of the organization’s cost structure, scouring all expenditure categories in search of incremental efficiencies that operators can extract. It mainly focuses on the operator’s realized costs—i.e., those related to productivity and employee behavior—by aligning incentives and effecting tactical process improvements to drive short-term performance gains. By assessing resource productivity and capital allocation, as well as return on investment, operators can flag selected expenditures for optimization, yielding benefits over a period of about three to 12 months.

Such measures aim to optimize usage or unit costs. In cases where there is no direct risk of disruption of business operations, these measures also can cap overall spending given expected returns. They can include changes in incentives, commission structure optimization, inventory management, CapEx prioritization, interconnection and settlement rates review, head-count management, and vendor and contract management (see “Sourcing Management Can Reduce Spending”). The results can be impressive; incremental efficiency initiatives can decrease operating costs by as much as 5 percent.

Some items on the financial statements of GCC operators are sig- nificantly higher than those of their European counterparts. For example, while European operators have slashed general and administrative expenses, GCC operators have not; they spend 25 percent more than European operators on such expenses relative to revenues.

Operators can accomplish many short-term measures in as few as three months and rarely longer than a year, depending on the complexity of the initiative. Compared to the other two waves, optimizing a budget or enhancing productivity are simple to set as targets but more difficult to implement. In general, the implementation of these initiatives requires close coordination and monitoring across different company sectors.

Sourcing Management Can Reduce Spending In an initiative that spans Wave 1 and Wave 2, operators can achieve savings of 11 to 16 percent on supplier contracts, by better managing their contracts, materials, and other external spending. The scope of these addressable costs varies by operator, depending on how much each operator relies on external providers and outsourcing, but they typically exceed 25 percent of operating expenditures.

To realize these savings, operators should begin by addressing vendor and contract management. This can include consolidating the number of suppliers, reviewing the duration of contracts, and reducing the number of specifications, all of which streamline vendor relationships. Operators with international footprints can also negotiate group-level contracts on high volume purchases of network spare parts and infrastructure, and commodity pricing on items such as vouchers and SIM cards. These measures generally deliver savings on addressable costs of 5 to 10 percent in the short run. One mobile operator was able to go beyond that average, recognizing savings of 12 percent on handsets and network OpEx sourcing. To do so, it increased competition among its suppliers by reviewing its vendor portfolio, introducing supplier score cards to monitor vendors’ performance, re-negotiating contracts, and introducing a bidding process.

In conjunction, operators should kick off a full procurement transformation, including a reengineering of supply chain processes and procurement operations, which can take up to 18 months. At the operational level, operators can automate processes in procurement and purchasing and more effectively integrate suppliers with business operations. From a strategic perspective, operators can rationalize requirements and the supply base, and ensure high spend visibility through effective reporting. Adopting an electronic procurement process, for instance, can increase transparency in spending, reduce cycle times, lower transaction costs, and consolidate spending. Similarly, operators can recognize significant savings by standardizing working specifications for standard components as well as contract terms. One international operator has achieved more than 15 percent in savings on addressable spend by conducting a detailed assessment of its external spend by organizational unit, supplier, and type of spend, and rationalizing its specifications.

Wave 2: process reengineering

The next wave of cost optimization involves changing the way a company operates. This considers systemic costs—i.e., costs that are incurred by the company’s processes and policies. Through reengineering of policies, processes, and procedures, Wave 2 initiatives typically generate savings within a year to 18 months through the implementation of lean operations. Implementation requires transformational activities of selected functions, tackling cross- functional opportunities.

Such measures will transform the way that some functions operate, and foster cross-functional opportunities.

One key example involves focusing on sourcing, an initiative that can enable savings of as much as 11 to 16 percent of supplier contracts (see “Sourcing Management Can Reduce Spending”). Operators with a global footprint can derive even greater sourcing savings by leveraging group synergies.

Moreover, operators can use analytical marketing techniques to segment their customer bases, allowing them to address specific needs of customers, tailoring customer care and services such as call routing, retention management, and fair usage policies. A deeper and more granular understanding of its customers allows the operator to deploy resources more efficiently.

Bad debt management is another area where regional operators can improve efficiency (see “A Holistic Approach to Managing Bad Debt Levels”). This encompasses initiatives throughout the customer life cycle, from customer acquisition to debt recovery. A segmented approach in which operators use analytical marketing data to understand their customers and establish segmented policies will allow them to create better policies for credit limits, billing cycles, and payment notification. These steps can rapidly reduce bad debt expenses to well under 1 percent of postpaid revenues. The use of electronic channels—such as paperless billing and prepaid top-ups—can also enable operators to reduce their operating expenses.

Bad debt management is another area where regional operators can improve efficiency (see “A Holistic Approach to Managing Bad Debt Levels”). This encompasses initiatives throughout the customer life cycle, from customer acquisition to debt recovery. A segmented approach in which operators use analytical marketing data to understand their customers and establish segmented policies will allow them to create better policies for credit limits, billing cycles, and payment notification. These steps can rapidly reduce bad debt expenses to well under 1 percent of postpaid revenues. The use of electronic channels—such as paperless billing and prepaid top-ups—can also enable operators to reduce their operating expenses.

Regional operators that have introduced electronic prepaid top-ups have realized savings of as much as 1 percent of corresponding sales on plastic recharges. Introducing paperless billing to businesses and government agencies also can rapidly yield sizable savings.

Wave 3: Restructuring the value chain

Beyond the short- and medium-term initiatives, operators can benefit from restructuring their value chain. Whereas the previous waves change how operators go about their business, this wave fundamentally changes what it is that they do by reconsidering structural and inherent costs—i.e., those generated by the company’s chosen business models and its overall scope of operations. Operators will be primed to pick their fights along the value chain, maximizing the monetization of investments in retained operations while divesting those activities that do not truly reflect the business’s strengths or long-term goals. In this wave, operators can realize cost improvements by focusing on a number of important areas.

Although there are many initiatives that operators can tackle in Wave 3, the most pressing areas today include capabilities-driven outsourcing, fixed–mobile integration, network-sharing models, and virtual network enabling (VNE) partnerships.

Capabilities-Driven Outsourcing

Capabilities-Driven Outsourcing

Telecom operators typically have outsourced non-core activities—sup- port functions such as information technology, human resource management, payroll, collection, and logistics. As industries mature, such functions become commodities that are difficult to differentiate from the offerings of competitors. In this regard, telecom operators can also benefit from outsourcing core telecom activities that are not part of their differentiated set of capabilities—the key strengths that set the company apart from its rivals. This would enable the business to focus on the activities that support its “right to win” or its ability to compete with confidence and create value. Every operator must define its strategy and then align its products and services with that strategy in order to outperform the competition.

Telecom operators then can outsource selected components of the value chain not integral to their strategic focus—areas such as network operational functions, including planning; and select customer-facing functions, including sales, customer care, and billing. Some regional companies have already begun to outsource some core telecom activities. For example, a few regional operators have spun off their call centers into stand-alone entities, or are considering taking such actions.

The financial upside from outsourcing will vary depending on market conditions. However, the outsourcer can expect to derive efficiency gains of at least 10 to 15 percent from process optimization, and as much as 15 to 20 percent due to economies of scale. Outsourcers with offshore capabilities can derive further savings on labor arbitrage, but this will entail removing the entire function—and underlying jobs—from the country.

Fixed–Mobile Integration

Incumbent operators typically integrate fixed and mobile technology when they migrate to next-generation networks, which affords opportunities to identify and capture synergies. Integrating technology on fixed and mobile systems typically generates the most savings—more than half of total integration savings—and leads to EBITDA improvement of 7 percent to 11 percent. Operators can also realize synergies in their fixed and mobile platforms in areas such as customer care, sales outlet rationalization through a shift to one-stop-shopping stores, and marketing and product development. These savings could lead to EBITDA improvement in the 2 to 3 percent range over the long run. Finally, product development and marketing integration with loyalty programs can yield cost and revenue synergies through converged offerings, which can enable operators to reduce customer churn and help them gain market share.

Network Sharing

Regional operators can use network sharing to enhance their mobile infrastructure and monetize their asset base. Potential network-sharing models include spinning off entities and transferring ownership of passive or active infrastructure investments.

Such moves would enable operators to benefit directly from the economies of scale generated from pooling infra- structure. It also would enable them to concentrate and invest in other areas, such as new technologies or services. Several GCC countries have already begun implementing models that would encourage operators to engage in wide-scale network infra- structure sharing.7 These include the deployment of national broadband networks that would be available for use to all operators, as well as the establishment of separate companies to manage towers and passive infra- structure. Operators not currently involved in one of these initiatives can engage regulators in dialogue to secure subsidies for the creation of a stand-alone entity.

Virtual Network Enabling Partnerships

Regional facility-based operators can enhance their assets and capture economies of scale by setting up vir- tual networks. Some regional operators are establishing virtual networks for mobile, and more recently, fixed voice and data, to target customer segments outside of their focus. In essence, these operators are leveraging the expertise of an outsider, or a virtual network operator, to offer ser- vice to a targeted customer segment.

Partnership models can address infrastructure, innovation, and marketing and sales. For example, operators can forge partnerships with retailers that have proven abilities to serve specific customer segments such as small and medium-sized enterprises (SMEs).

There are two key benefits of virtual networks. First, they capture additional business opportunities through the value they add to operations. In addition, these network partnerships maximize the utilization of fixed assets, providing the operator with the opportunity to leverage or derive scale from its existing investments.

Managing Redundancies

All of the structural initiatives inevitably will create head-count redundancies. Traditional methods that operators rely on to deal with this issue—early retirement, outplacement, and layoffs—may prove difficult regionally for a variety of reasons, ranging from labor laws to the need to preserve public image and create jobs, especially for young nationals.

One possible solution to cope effectively with redundancies is to make use of a special employment entity (SEE), a separate unit created for excess staff for a given period of time (see “Case Study: DT Creates Vivento to Handle Staff Surplus”). SEEs carry out operational activities and support the transition of redundant employees into productive sectors. SEEs pro- vide employees with opportunities to develop their skills through a wide variety of academic and vocational training initiatives. This structure could result in a five-fold increase in attrition and an opportunity to monetize redundant employees. It also allows operators to focus on their core operations and performance as cost of excess staff away from their balance sheets.

CONCLUSION

Telecom operators throughout the GCC region have generally sustained strong results in recent years, but they are not immune to the global threats that are exerting pressure on the sector’s profitability and shareholder returns. With sky-high penetration rates, the advent of increased compe- tition, and the growing sophistication of consumers who are demanding more, GCC operators are beginning to feel the strains that have slowed to a crawl the industry’s growth in other regions of the world.

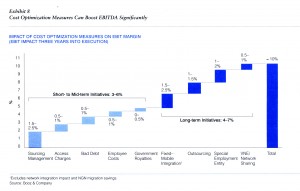

So far, regional operators have focused on only short-term and limited cost optimization efforts in order to rein in costs. The benefit of implementing all-encompassing cost optimization initiatives is promising (see Exhibit 8). Short- to medium- term initiatives—i.e., sourcing improvement and head-count management (which incorporate optimized IT, network, and market- facing operations), access charges, and bad debt management—can have a marked impact on the bottom line. Employee reduction measures such as targeted early retirement programs would also help operators improve their results.

Long-term structural initiatives likewise can help boost profitability and enable operators to focus on their core capabilities, helping them to differentiate their business model and succeed. The initiatives with the highest potential include fixed–mobile integration on the technology side, outsourcing of both non-core and non-differentiating core services, and redundancy management measures such as the SEE.

GCC telecom operators should act now, before markets fully saturate and further fragment, to implement the optimization initiatives that will allow them both to streamline their operations and position themselves for future growth.

March 6, 2026