5G an Economic Driver

Today, the ability of 5G goes far beyond providing superior mobile services to consumers. The speed at which 5G is evolving and the possibilities it unlocks in the form of use cases is accelerating digital transformation across all industry verticals. The 5G value chain will have an immense contribution to the global economy, as fast and intelligent internet connectivity enabled by 5G technology is expected to create approximately $3.6 trillion in economic output and 22.3 million jobs by 2035.

Realizing the economic opportunity driven by 5G, operators in the Gulf Cooperation Council (GCC) have made significant progress and have quickly rolled-out 5G deployments with the support from regulators in their respective countries. The economic potential of 5G has been a strong motivator for this quick 5G deployment. It is estimated that 5G technology has the potential to boost the GCC economy by $269 billion over the next ten years and 5G adoption will reach 16% in the GCC by 2025 with 20 million 5G connections, ahead of the global connection rate that is assumed to reach 15 globally.

GCC Operators Leading 5G Deployments

With an aim to emerge as a global leader in 5G deployments mobile operators in the GCC have aggressively pushed ahead with trials and early commercial launches. Between May and June 2018, Etisalat, STC, Zain and Ooredoo all stated that they had launched 5G in their respective markets. Although Fixed Wireless Access (FWA) was the initial use case back in 2018, the first 5G mobile services were commercialized in 2019, with the launch of 5G smartphones. Currently in UAE, Saudi Arabia and Qatar, several commercial offering have been deployed and as more cost effective 5G- ready smartphones and devices hit the market, it will further boost B2C deployments of 5G.

Continuous coordination between all eco-system players has been the driving force behind the success seen in the GCC. Mobile operators in the region have undertaken several projects and initiatives which include collaboration on the development of industry standards (3GPP’s work) and agreements with major vendors such as Huawei, Ericsson, and Nokia. These collaborations have further driven 5G developments and have also helped in finding the most appropriate network deployment model while identifying viable use cases. GCC mobile operators have also formed memoranda of understanding (MoUs) to jointly develop and test selected 5G and IoT use cases.

5G technology represents a significant opportunity for all eco-system players in the GCC, considering its ability to support the development of countless new B2C and B2B services and its potential to revolutionize several industry verticals by supporting the deployment of innovative use cases, 5G has been the focus of attention for all mobile operators in the region. However, to build on this momentum and maximize from the 5G opportunity, operators and technology provider must develop more use cases and need regulators to support them by allocating sufficient spectrum across low, medium, and high bands.

5G Use Cases Changing the Industry

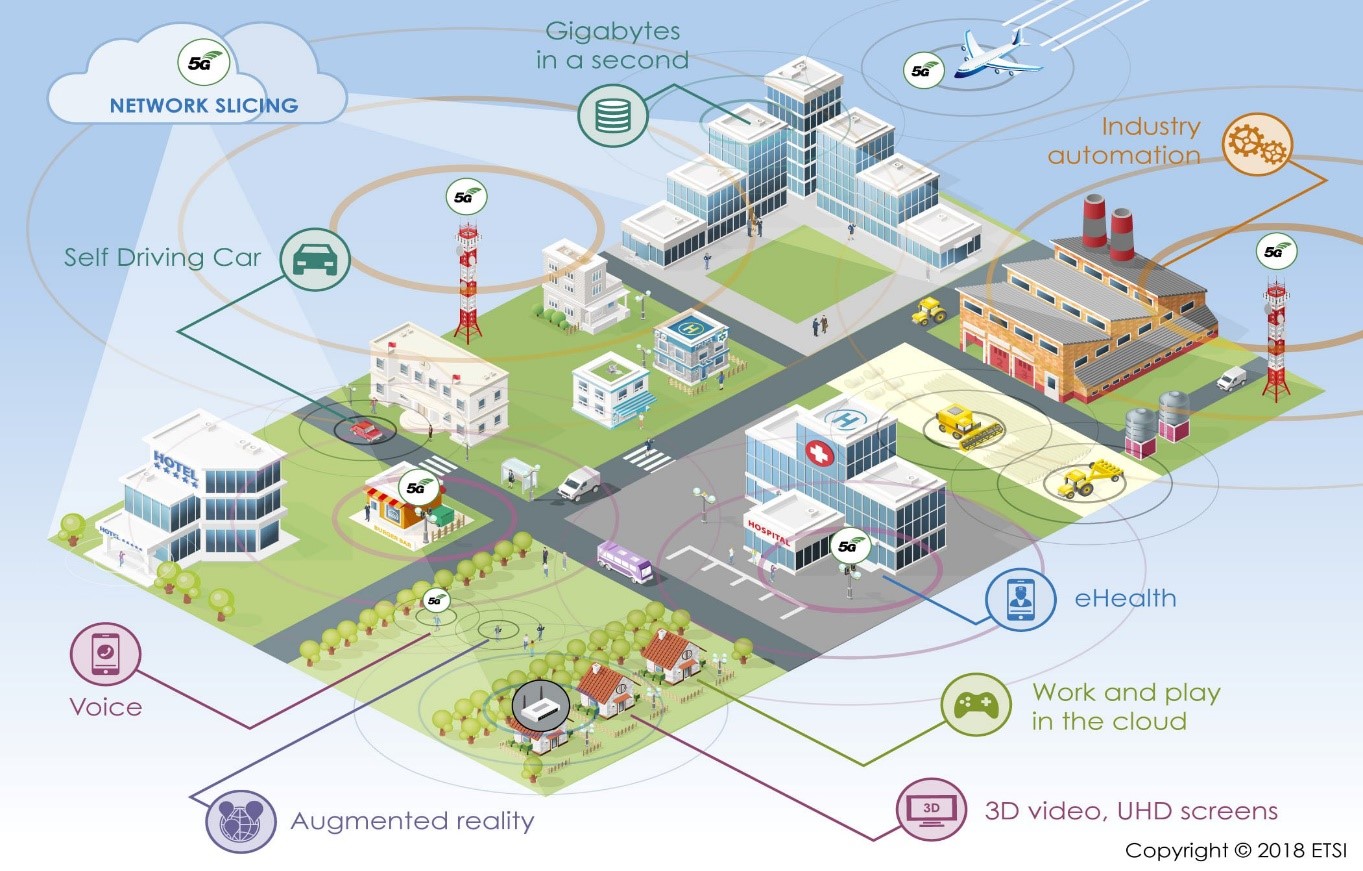

The launch of 5G has marked the arrival of next generation wireless connectivity. This next-gen wireless network has the ability to support huge number of connections simultaneously while improving speed, latency, reliability, and power consumption for handsets and Internet of Things (IoT) devices. This has catapulted the realization and seamless delivery of concepts such as Industry 4.0, Augmented/Virtual reality (AR/VR), Massive Machine Type Communication and Smart Cities with eSports and enhanced in-venue digital entertainment. The prospect of 5G technology involves capabilities which will make an immense contribution to the digital transformation of industry verticals and will serve as an enabler to use cases relying on ultra-reliable, low latency and highly available internet connections. Eco-system players such as mobile operators, technology providers, regulators and end-users are eager to harness 5G’s potential and have already started deploying uses cases in a range of different sectors to strengthen local and national economies. Some of the prominent uses cases which have emerged in the region are based on:

Internet of Things

Considering the IoT market in the MENA region is still in its infancy compared to the other mature markets, the arrival of 5G is likely to accelerate developments. GSMA predicts that there will be 1.1 billion IoT connections (cellular and noncellular) in MENA by 2025. Due to the diversity of IoT applications and services, different access technologies will address different requirements. 5G will play a key role in supporting the next phase of digital transformation and will drive greater adoption of IoT in different sectors, particularly industrial IoT applications, which will account for almost 60% of the 1.1 billion IoT connections in the region by 2025.

Transformative Technologies

To drive the agenda of digital transformation and position the region as a thought leader in emerging technology deployment, several regional eco-system players have brought to life technologies such as Edge Computing, AI and Blockchain. As organizations realize the potential of these technologies which are underpinned by 5G, it is expected that spending on Edge Computing, AI and Blockchain will considerably rise in the coming years. Regional leaders like UAE and Saudi Arabia are at the forefront of deploying emerging technologies to transform critical sectors such as Healthcare, Utilities and Education. 5G use cases in Healthcare such as Telemedicine, Remote Surgery and Smart Grids and Metering in Utilities will rely on 5G technology.

Immersive reality

According to a GSMA Consumer Survey, mobile users in the GCC Arab States are highly engaged in the digital world. Their engagement is as high as that of mobile users in North America and the more tech-advanced countries across Europe and Asia Pacific. With the growing popularity of online gaming, entertainment e-commerce and digital education, mobile users are more engaged than ever. Keeping the user engaged with new interactive content and experiences which are seamlessly delivered is key for user retention. 5G has tremendously helped content developers to introduce and deliver their content in an Augmented or Virtual environment, thereby maximizing user interaction. However, interactive AR/VR content delivered in real time needs high bandwidth and ultra-low latency connections which have the capacity to transfer large volumes of data and from multiple devices at the same time. Existing connections alone do not have the ability to cope up with this growing demand, which can only be catered by 5G connectivity. 5G networks will be key to supplement existing 4G networks and supply the mobile data traffic capacity required for seamless delivery of immersive reality.

As innovative 5G uses cases get deployed, it extremely important to take into consideration the availability of spectrum. The success and commercialization of any 5G use case depends on the availability of spectrum in the right frequency band. If regulators do not allocate more spectrum across low, medium, and high bands the scope of 5G use case development is limited and will severely impact the realization of 5G’s full potential. Eco-system players need to collaborate to discuss the best ways to solve the spectrum challenge.

The Need for Additional Spectrum Allocation

Operators throughout the MENA region have already invested nearly $120 billion between 2018 and 2020. With growing consumer demand for 5G connectivity and rapidly developing enterprise 5G use-cases, an additional 5G capex will likely be required between 2020-2025. Given that an increasing number of operators are testing 5G services across the region, 5G spectrum availability remains an issue. According to MENA operators, the amount of spectrum allocated for 5G trials is not enough in some countries to allow wider scale trials or fully exploit early 5G developments.

Spectrum is considered as the fuel to develop a robust 5G ecosystem, without which no 5G network infrastructure or devices can operate at its full potential. The future of 5G networks will rely on a combination of mainstream and alternative technologies and will use both licensed and unlicensed spectrum across different spectrum bands together. In order to realize the potential of a digital society, capable of deploying use cases like public security, IoT, and industry automation, additional suitable spectrum bands are needed for current and futuristic 5G systems.

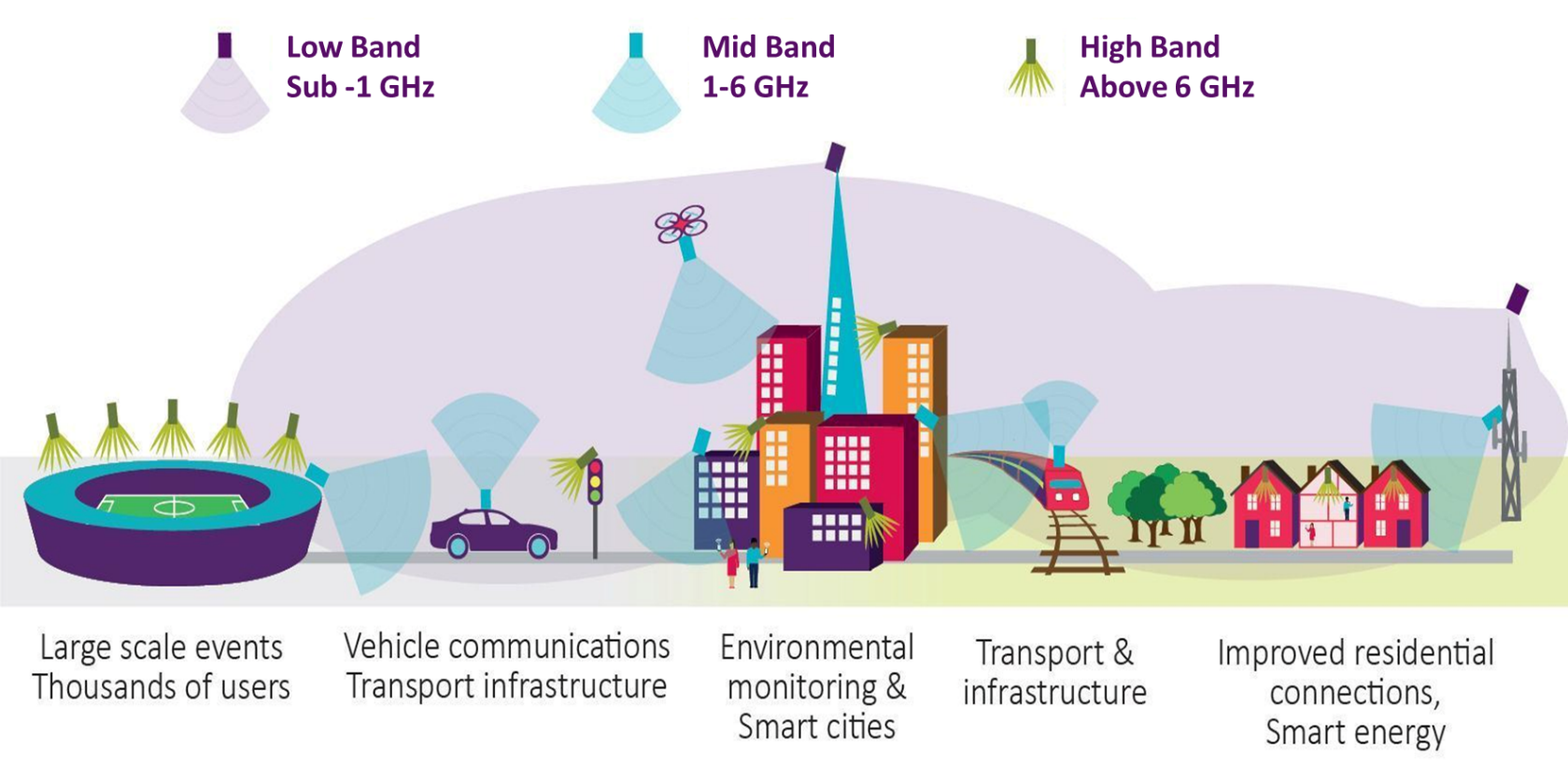

Successful 5G deployment need three key frequency ranges- Sub-1 GHz, 1-6 GHz, and more than 6 GHz- to ensure widespread coverage and to support different use cases.

Sub-1 GHz

To support wider coverage across urban and rural areas the Sub 1-Ghz frequency would be necessary. This would not only support IoT implementations but would also provide energy efficient wireless data communication to enable smooth functioning of smart home technologies. The Sub 1GHz band is specifically designed to support applications that require short range and low data rates.

1-6 GHz

The 1-6 GHz frequency range which is capable of delivering both capacity and coverage includes spectrum between 3.3 and 3.8 GHz and will be essential in laying the foundation for initial 5G deployments and services.

The 3.4-3.6 GHz range which is almost globally harmonized is driving the economies of scale needed for low-cost devices. A number of countries are also discussing the prospect of using other bands such as 3.8-4.2 GHz, and spectrum in the 4-5 GHz range, in particular 4.8-4.99 GHz. Although the 1-6 GHz range is being currently used by several operator who are operating on LTE networks, there are numerous other mobile bands in the 1-6 GHz range which could be gradually restructured for 5G use. It is estimated that the use of this band will continue to grow not only for 5G but for LTE too.

6GHz: Growing Importance

Several developed telecom markets are currently focusing on the 6 GHz band (5925-7125 MHz) which is being considered for licensed 5G as well as a new unlicensed band. To keep up with the growing adoption of 5G, a new licensed 5G band within 6 GHz will play a particularly important role. It is recommended that at least 6425-7125 GHz is made available for licensed 5G. Countries like China are planning to license the 6GHz band and make it completely available. Whereas countries like US supports unlicensed use of this band, while the European region has opted for unlicensed use in the lower portion of the band (below 6425MHz). The unique benefits of this range which delivers a mixture of coverage and capacity, cannot be replaced by mmWave or coverage bands. To deliver robust 5G services the 6GHz band will play a vital role in the near future.

Above 6 GHz

To support projected extensive mobile traffic growth and deliver significantly faster data speeds over 5G, a range that exceeds 6 GHz will be required to support this seamless delivery of ultra-high broadband speeds. The spectrum being targeted above 6 GHz is expected to comprise a mixture of licensed and unlicensed mobile bands. 5G mobile bands which are being considered by WRC-19, under agenda 1.13 are 24.25-27.5 GHz, 31.8-33.4 GHz, 37-43.5 GHz, 45.5-50.2 GHz, 50.4-52.6 GHz, 66-76 GHz and 81-86 GHz. Although, some countries are exploring bands like 28 GHz which have not been considered by WRC-19 but there is an incremental value as the 28 GHz band would complement the 24 GHz band (being considered by WRC-19) as the same equipment could easily support both.

Regional Spectrum Allocation

Initially it was estimated that early 5G deployments in the region would need spectrum allocated between 80 – 100 MHz of mid-band spectrum within the 3300 – 4200 MHz and 4400-5000 MHz bands, and 400 – 500 MHz of high-band spectrum within the 26 GHz, 28 GHz, 39 GHz, and 42 GHz bands per operator. Although regulators in the region have already licensed and allocated some of the harmonized spectrum suitable for 5G, which was a requirement to achieve early mass market services and use case deployment, an additional 80-100 MHz of mid-band spectrum and 1 – 2 GHz of high-band spectrum per operator will be needed. Spectrum in the low-bands 450 MHz, 600 MHz and 700 MHz bands will also be needed to connect the rural areas and to increase geographical network coverage to ensure successful implementation of IoT and Edge computing solutions. Additionally, renewal of spectrum needs to be reasonably priced to allow for meaningful network deployments which could address the ICT policy objectives.

The approach adopted by governments and regulators will have a significant impact on the true realization of 5G deployments and will also shape the future of a country. To use 5G as a driver to accelerate the economy with the help of innovate solutions and use cases, allocation of additional spectrum will be pivotal. Regulators need to ensure spectrum is allocated as per the International Telecommunications Union. While 5G is undeniably a revolutionary technology, its potential is limited based on availability and allocation of spectrum.