Inter-satellite communications via optical links are rapidly becoming the preferred means of transmission in space. This is opening up a dynamic new market for optical communications terminals and inter-satellite links driven by the growing number of NGSO broadband constellations. Euroconsult’s newly released report ‘Optical Communications Market’ contains market-leading in-depth analysis of the equipment and solutions using optical links, with the 1st edition purposefully held back until now to ensure that the emerging market is best represented.

Optical communication data transmission offers many potential advantages to satellite operators, including higher data throughput rates, which are essential for handling the continuous global increase in demand for data exchange. Another key advantage is the narrowness of the light beam, which makes it more complicated to intercept and helps ensure information security. Source incoherence also significantly reduces communication systems interference, an essential prerequisite for large constellations.

According to Euroconsult’s report, major satellite constellation operators see the benefits of switching inter-satellite communication from mainly by radiofrequency electromagnetic waves to optical or laser communication, but there are key technological challenges to address before widespread adoption, including link reliability governed by beam accuracy.

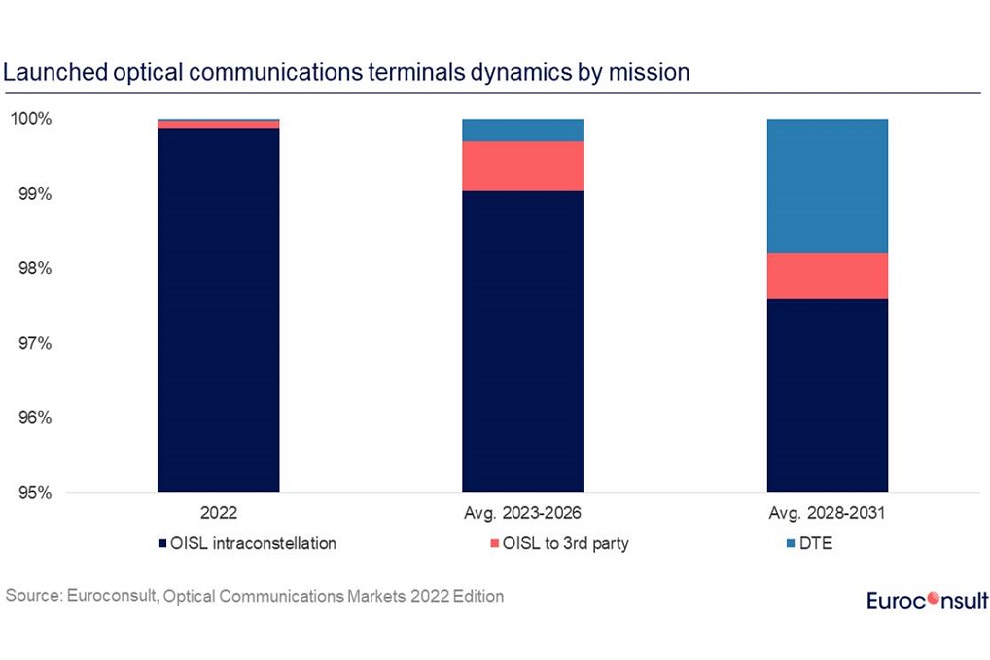

Euroconsult remarks that, over the three categories of applications for optical communications terminals, inter-satellite links (ISL) are largely dominant, driven by increasing adoption among NGSO broadband constellations. Optical inter-satellite links (OISL) terminals are expected to surpass 70,000 units in orbit by 2031.

Optical communications will also enable data-relay space services thanks to terminals used for third-party communications, usually to transfer data to satellites orbiting at different altitudes. Companies such as Skyloom have been founded in this purpose. Though less than 10 data-relay capable satellites were in orbit at the end of 2021, the number of such terminals should constantly grow over the decade to reach 250 units by 2031. Earth observation (EO) data providers are expected to be the main stimulators for this growth.

A further type of optical communication terminal will be used for Direct-To-Earth (DTE) communications, but given the physical constraints for such communications, the technology is not yet mature and development efforts are being made by most manufacturers. However, the technology is still expected to equip a rising number of satellites post-2025 and should reach around 450 units by 2031, encompassing most satellite applications.

In order to support manufacturing development, standardization efforts are being undertaken at the initiative of the US government under its Space Development Agency (SDA) program with the objectives of lowering prices and increasing technology adoption across different types of satellites. For instance, current prices of around a million dollars per terminal are expected to decrease to less than $100,000 at the end of the decade. Current market leaders such as TESAT-Spacecom, Mynaric and Honeywell are all taking part of this initiative. Potential new entrants are also involved and are ready to take their shares of the market when it will accelerate.

Euroconsult’s 1st edition ‘Optical Communications Market’ report provides an in-depth insight into the economic impacts of this emerging market, reviewing key players, as well as the opportunities and challenges experienced for the technology as the market matures.