Arthur D. Little’s 2011 Telecoms Infrastructure Supplier Outlook

Dr. Karim Taga

While established vendors have continued down their previous strategic paths, attempting to merge and integrate, Huawei came within a whisker of overtaking even Ericsson on a revenue market share basis. Moreover, most former sector leaders are still experiencing weak financial performance, and are in danger even being overtaken in innovation and product leadership by their emerging competition.

After its successful 2008 Telecoms Infrastructure Supplier Outlook, Arthur D. Little has again reviewed the performance of leading telecom suppliers and conducted a global survey of Chief Technology Officers (CTOs) to ask for an update on their perspective on sector developments and challenges ahead.

Arthur D. Little conducted its 2nd global equipment supplier survey from June to November 2010. CTOs and leading industry experts were questioned on 16 technology areas with a focus on the positioning of 11 key suppliers, which account for approximately 70 percent of global CAPEX in 2010. Products and services were reviewed in the same three areas as in the previous report: access network infrastructure, core & transmission network infrastructure and services.

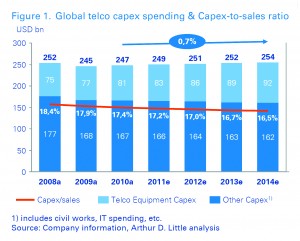

Capex spending by telecom operators remains stable at 0.7 percent CAGR 2010-2014

Supplier revenues are principally driven by telecom operators’ capex spending, especially on equipment. As a result, this spending directly impacts suppliers’ growth outlook. A detailed analysis of the capital expenditure of the world’s Top 100 telecom operators indicates a decrease in the capex-to-sales ratio to 16.5 percent by 2014 (down from 18.4 percent in 2008). With industry revenues expected to grow at a modest 2 percent p.a., overall capital expenditure will thus remain stable (0.7 percent CAGR) over the forecast period, with growth coming from spending on equipment (see Figure 1, overleaf).

Supplier revenues are principally driven by telecom operators’ capex spending, especially on equipment. As a result, this spending directly impacts suppliers’ growth outlook. A detailed analysis of the capital expenditure of the world’s Top 100 telecom operators indicates a decrease in the capex-to-sales ratio to 16.5 percent by 2014 (down from 18.4 percent in 2008). With industry revenues expected to grow at a modest 2 percent p.a., overall capital expenditure will thus remain stable (0.7 percent CAGR) over the forecast period, with growth coming from spending on equipment (see Figure 1, overleaf).

Wireless access infrastructure, already accounting for 43 percent of total telecom infrastructure capex, will increase its overall share as spending continues to shift away from fixed infrastructure. As a consequence, the rollout of LTE networks in Europe and North America, and 3G deployments in India and South America will be key drivers of overall equipment revenues. In addition to the above mentioned coverage rollouts, wireless capex is expected to shift towards capacity over the next few years.

Fixed infrastructure is still burdened by slow investment into FTTx due to regulatory uncertainty. The increasing trend of sharing investments into next generation networks among operators could also reduce the number of competing infrastructures and thereby the suppliers’ addressable market.

Operators are also expected to focus on cost efficiencies and their core business, resulting in double-digit growth rates for Network Services (Operations & Management) and Managed Network Services.

In addition, emerging market growth has outpaced mature markets in all infrastructure categories, with emerging markets expected to account for 56 percent of overall revenues by 2015.

Value shift among suppliers continues, but consolidation has not brought market repair

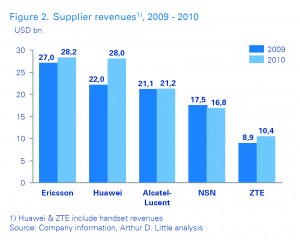

At the end of 2010, Ericsson, Huawei and Alcatel Lucent emerged as potential challengers in the race for the telecom infrastructure market (see Figure 2).

At the end of 2010, Ericsson, Huawei and Alcatel Lucent emerged as potential challengers in the race for the telecom infrastructure market (see Figure 2).

During the preceding two years, there was significant market consolidation. 2009 saw large-cap deals with CISCO acquiring Tandberg (USD 3.4bn) and Starent (USD 2.9bn), HP entering into the networking equipment sector through its acquisition of 3COM (USD 2.7bn) and Ericsson cherry-picking Nortel’s CDMA and LTE assets (USD 1.13bn).

In 2010, besides the acquisition of Motorola’s wireless network unit by Nokia Siemens Networks for USD 1.13bn (currently under renegotiation), deal sizes were much smaller (less than USD 100m) and focused on niche players in network services and IT.

The turmoil in the telecom supplier market is best illustrated by the rapid ascent of Huawei to become number two in terms of revenue through both organic growth and the demise of Motorola. Huawei started to gain momentum in 2007 after the World Mobile Congress in Barcelona and the InfoVision Awards. Initially, a low price strategy helped Huawei to gain market share around the world. Deployment of 3G in China last year further boosted their revenue. Increasingly, Huawei is also recognized for highly innovative products (e.g. SingleRAN), thereby setting the foundation for further expansion.

In contrast, Motorola’s infrastructure division has continually lost ground since 2007 against the leading vendors in the telecom infrastructure market. They could not find a strong foothold in the 3G market and their bet on WiMAX and, in particular, on the North American market did not pay off. This troubled position eventually led to its sale to Nokia Siemens Networks in 2010.

The wireless infrastructure segment is shifting further to a buyer’s market with aggressive upcoming swap deals. Technological advances such as Single RAN further focuses the industry, but market shares suggest an end to consolidation. Fixed infrastructure is still a highly fragmented segment, thus further vendor consolidation is to be expected. In Managed Network Services, Ericsson and NSN are still market share leaders, but IT players and smaller competitors are increasing fragmentation.

However, when analyzing operating margins of suppliers, it is clear that market repair has yet to take place despite six years of consolidation. In addition, Asian attackers and IT players are taking increasing market share from established vendors.

Technology & Business Model innovations require suppliers to re-think

The current megatrends in the telecom industry have pushed suppliers into an innovation race in terms of both technology and business models.

HSPA+ vs. LTE – Mobile traffic is projected to increase by a factor of 32 by 2015, however without the need for significantly higher wireless access capex. Until 2014, the best technology choice for most operators is HSPA+ rather than LTE. However, operators will need to redouble their efforts in traffic offloading through fixed access points (WiFi & femtocells), particularly in urban areas. Backhaul technology could become a sweet spot for telecom equipment providers in the years to come, as Carrier Ethernet, fibre, and high-capacity microwave are still in an early deployment stage. Suppliers and operators should not repeat their 3G failures, but rather make smart decisions regarding HSPA+ vs. LTE.

RAN Sharing – Increasingly, operators are willing to build their next generation wireless access networks (e.g. HSPA+, LTE) jointly with competitors, and to a lesser extent with financial investors. The use of Single RAN equipment in these joint ventures will greatly increase the importance of vendors. A comprehensive wireless access portfolio (strong position in 2G, 3G and 4G) is essential. Joint ventures will enable suppliers to become the exclusive network infrastructure provider, and they will have the potential to move from supplier to full-fledged joint venture partner.

RAN Sharing – Increasingly, operators are willing to build their next generation wireless access networks (e.g. HSPA+, LTE) jointly with competitors, and to a lesser extent with financial investors. The use of Single RAN equipment in these joint ventures will greatly increase the importance of vendors. A comprehensive wireless access portfolio (strong position in 2G, 3G and 4G) is essential. Joint ventures will enable suppliers to become the exclusive network infrastructure provider, and they will have the potential to move from supplier to full-fledged joint venture partner.

Quality of Service – With increasing network congestion, operators will choose to differentiate between traffic classes. The separation of traffic into different classes will become ever more important. Offensive measures typically improve the user experience for traffic flows that are desired, known and managed, whereas defensive measures deter unsolicited/unwanted traffic. Operators and suppliers are expected to deploy solutions on wireless networks to improve the customer experience for high-value customers without detracting low-value subscribers.

FTTB/H – Future investment into very high broadband will be shared and mainly driven by non-telecom players. A staggering 65 percent of all households with access to FTTB/H networks in Europe are on networks deployed by fixed-line incumbents. Utility companies and alternative operators are expected to split the value chain as well as the financial investments, by forming innovative partnerships. Alcatel Lucent, for example, actively participates in landmark projects such as National Broadband Network Co. in Australia. Providing support and enabling innovative business models to break the investment barriers for FTTH will be key to suppliers success in this segment.

The challenges faced by telecom operators open a number of new opportunities for suppliers, but will require a radical rethinking of their business model and offering.

Little change in CTOs’ views of top suppliers, raising questions about the suppliers’ strategies

Overall, more than 80 surveyed CTOs did not see significant change in leading vendors’ positioning since the 2008 survey, raising questions over Western vendors’ strategies.

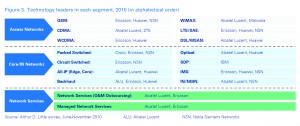

Western telecom suppliers’ are still perceived as technology leaders in most categories, but Asian attackers are increasingly seen as innovators. Alcatel Lucent and Ericsson were mentioned ‘leader’ 9 times (same as 2008) out of 16 categories, followed by Huawei with 8 (-1 vs. 2008), Nokia Siemens Networks with 6 (+2 vs. 2008) and Cisco, IBM and Motorola one time each (same as 2008).

With the exception of Nortel and Motorola, all suppliers broadened their portfolio, striving for a full-service supplier position. Despite only one mention as ‘leader’, in CDMA, ZTE is also slowly closing the gap on the tier 1 suppliers, being increasingly perceived as full-service supplier. Cisco is seen to be building up its portfolio through acquisitions. Ericsson, meanwhile, is still perceived to lack a comprehensive fixed network portfolio.

In the most promising technology segments over the next 5 years, CTOs clearly identified Alcatel-Lucent and Huawei as leaders in fixed (DSLAM/MSAN) and Ericsson, Huawei and Nokia Siemens Networks in mobile infrastructure (HxPA & LTE/SAE).

Huawei and ZTE hold leader positions in some of the categories, however, operators from emerging and developed regions have divergent views on their performance. Emerging market operators rank Asian vendors higher, whereas operators in developed markets feel they still need to improve organizational maturity.

Conclusion

Suppliers and operators will need to work together more closely to manage the transition from growth to efficiency while maximizing growth from emerging opportunities. Operators’ models will change dramatically and suppliers must respond to this.

To capture growth from these new opportunities, suppliers need to:

Adapt their business models to actively shape the market, nnleverage “swap” opportunities, co-finance and drive deals

Be equally strong in fixed and mobile, and particularly in core nnnetwork technology, which is moving ever closer to the base stations

Master all wireless technology generations, (e.g. 2G/3G and nn4G) in order to remain an attractive partner in Single RAN

Help operators to make smart decisions when deploying nnHSPA+ vs. LTE and push solutions to offload and prioritize traffic on wireless networks

Leverage a large FTTB/H opportunity by providing business nnmodels and support to break the investment barriers

Further stabilize trust by sharing roadmaps, managed nnservices, participating in the operator eco-system and embracing over-the-top solutions

Reshape portfolios as value is increasingly migrating towards nnIT (OSS/BSS) and Managed Network Service (new business models)

Key actions for operators include:

Continuously monitor the supplier ecosystem to test the nnvulnerability of their existing investments to disruptions in the supplier landscape

Watch for consolidation in the fixed infrastructure and nnnetwork service segments, not to bet on the wrong horse

Partner with suppliers in network sharing deals in FTTx nndeployment, as well as for LTE

Involve suppliers in early stages of business model nninnovation

Determine a healthy supplier mix in access, core, nntransmission and services.