Satellite service pricing, driven by next-generation satellite systems, continues to re-shape the industry, triggering a transition towards managed services and attractive $/GB economics

Euroconsult, the leading global consulting firm specializing in satellite-enabled markets, has released the latest edition of its FSS Capacity Pricing Trends report which unveils continued shifts in the capacity pricing landscape.

Satellite capacity pricing is experiencing rapid declines in an increasingly disruptive market, supported by rise of next-generation geostationary (GEO) and non-geostationary orbit (NGSO) high-throughput satellite (HTS) systems. Massive influx of supply in the market has ultimately contributed to a commoditization effect on connectivity, due to which the industry is witnessing a shift towards managed service offerings with attractive $/GB economics, primarily driven by Starlink.

Over the past five years, global average capacity pricing in video and data markets has dropped by approximately -16% (-3% CAGR) and -77%, (-26% CAGR) respectively. This decline is more pronounced in data markets due to abundant supply from NGSO (primarily Starlink) and HTS systems, while video markets have seen a lesser decline, largely due to stagnated regular supply and market stickiness to long-term contracted prices.

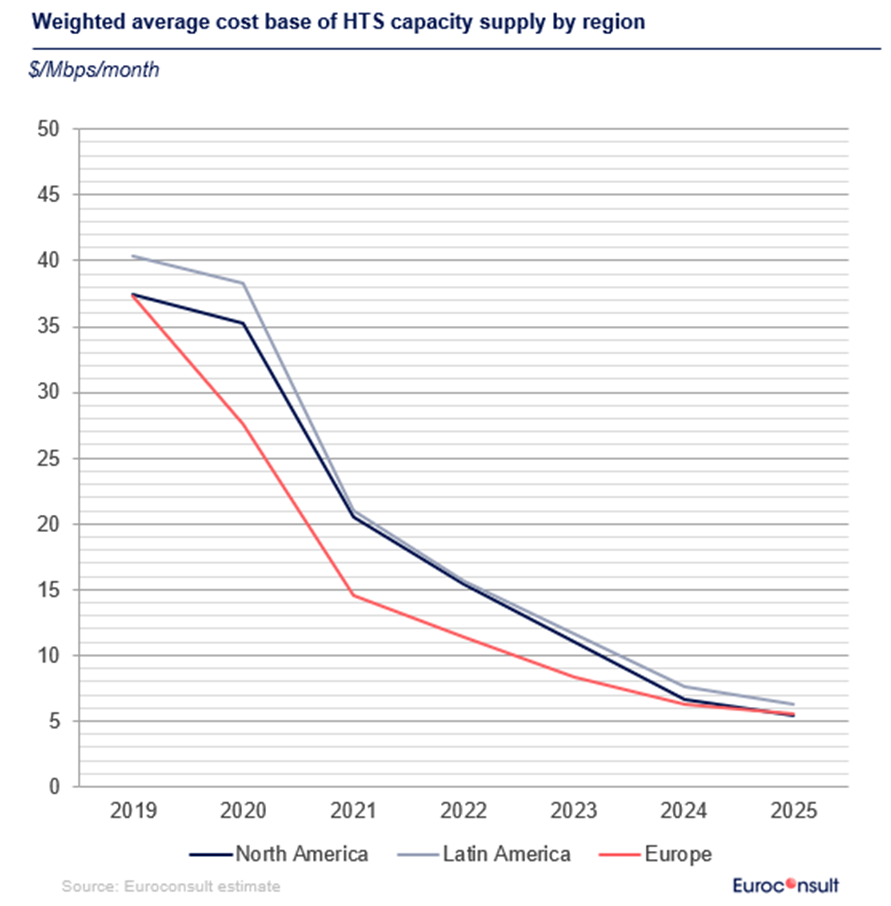

The report also notes that the decreasing cost base of capacity (indicating efficiency of capex invested in satellite manufacturing considering sellable capacity and expected lifetime), initiated with the advent of Starlink, is expected to stabilize over the next 2-3 years leading to a potentially slower capacity price erosion compared to previous years.

The dynamics outlined in the report signal continued changes for the industry, potentially marking a structural shift away from traditional wholesale capacity leasing towards managed service packages supplemented by value-added services. This shift is triggering a re-alignment of operational strategies among industry stakeholders. Operators are moving towards vertical integration by providing managed capacity plans to service providers and/or directly to end users. Service providers are increasingly opting for these pre-made packages from satellite operators to reduce capacity management complexities and focus more on providing value-added services (Cyber security, Cloud connectivity, Telematics & IoT solutions etc.)

“Starlink’s pocket-friendly pricing and higher availability of service plans have triggered a structural shift in the industry away from wholesale capacity leasing to more managed solutions, setting a wave of strategy re-alignment across players. Operators are choosing to directly serve end customers with managed service plans, giving them greater control over capacity prices, while service providers are moving away from capacity management and focusing on value add-ons,” said Senior Consultant Grace Khanuja.

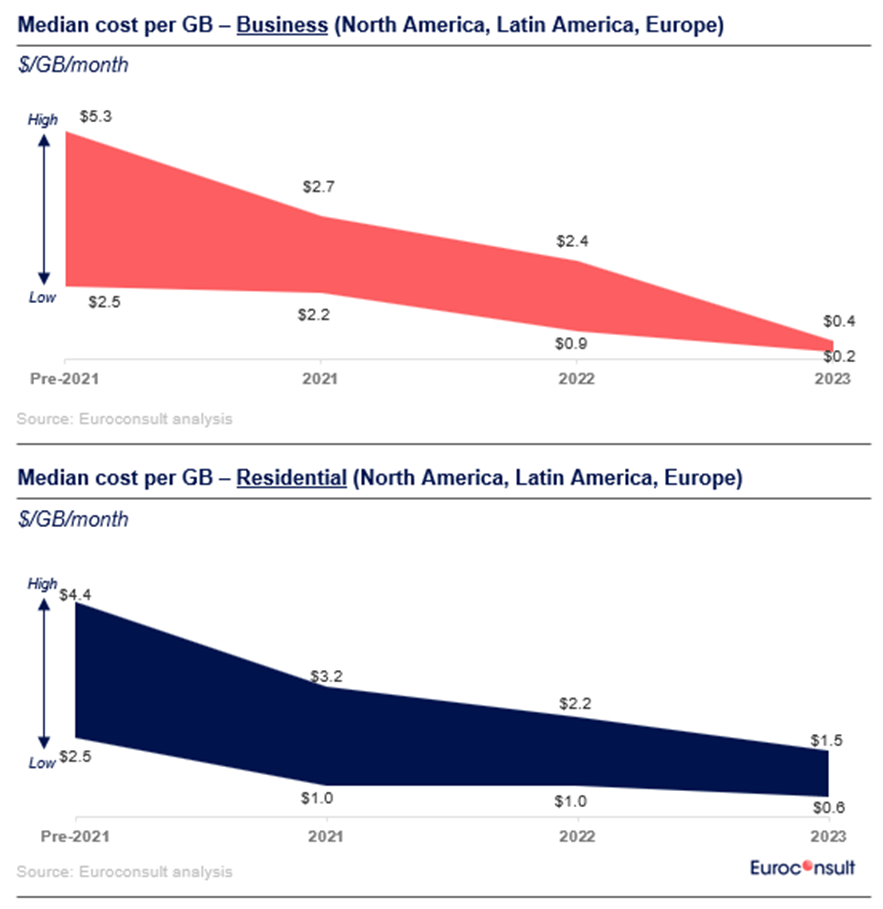

Owing to the shift in industry dynamics, the price per GB has witnessed a converging trend across key geographies over the past 3–4 years. The pre-2021 period was marked by median prices ranging from $2 to $5 per GB per month, given the limited available capacity of legacy satellite systems that constrained monthly GB allowances. The rise in available capacity supply with the launch of Starlink across markets coupled with new service plans from incumbent satellite players (such as Viasat, Hughes in the Americas, and Eutelsat Konnect in Europe) has abruptly lowered the price range to $0.2 to $1.5 per GB per month in 2023, given the disproportionate increase in GB allowances vs service plan costs.